In 2023, the European venture capital landscape veered away from the exuberant valuations and frenetic deal-making that characterised 2021, signifying a reassessment of investor expectations.

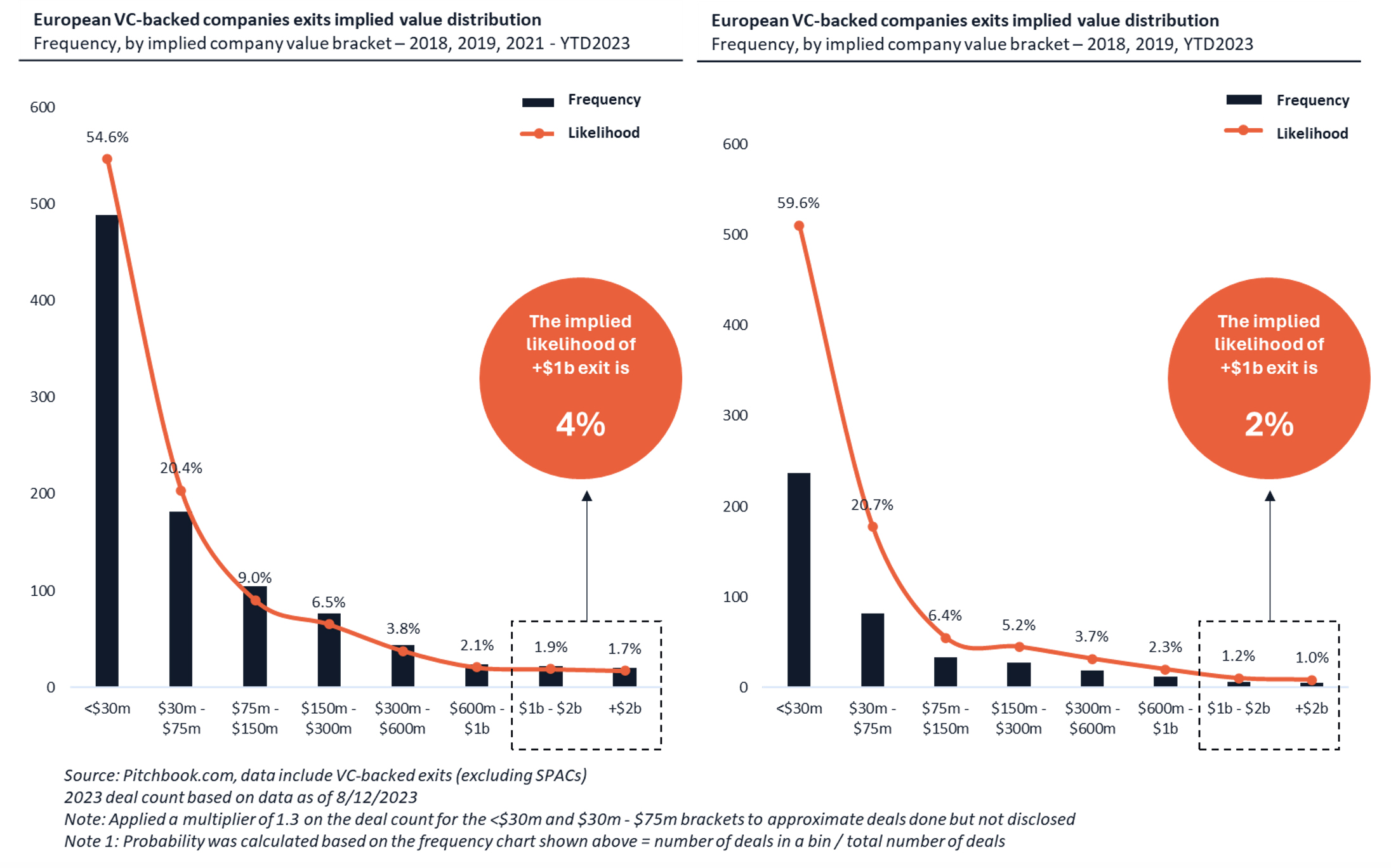

The once-standard benchmark of becoming a unicorn (achieving a $1 billion valuation or exit) was suddenly overly optimistic as the tightening of fundraising avenues spurred a hunt for more modest yet viable exit strategies. Amid these challenges, many companies leaned towards internal funding rounds and raised through convertible notes.

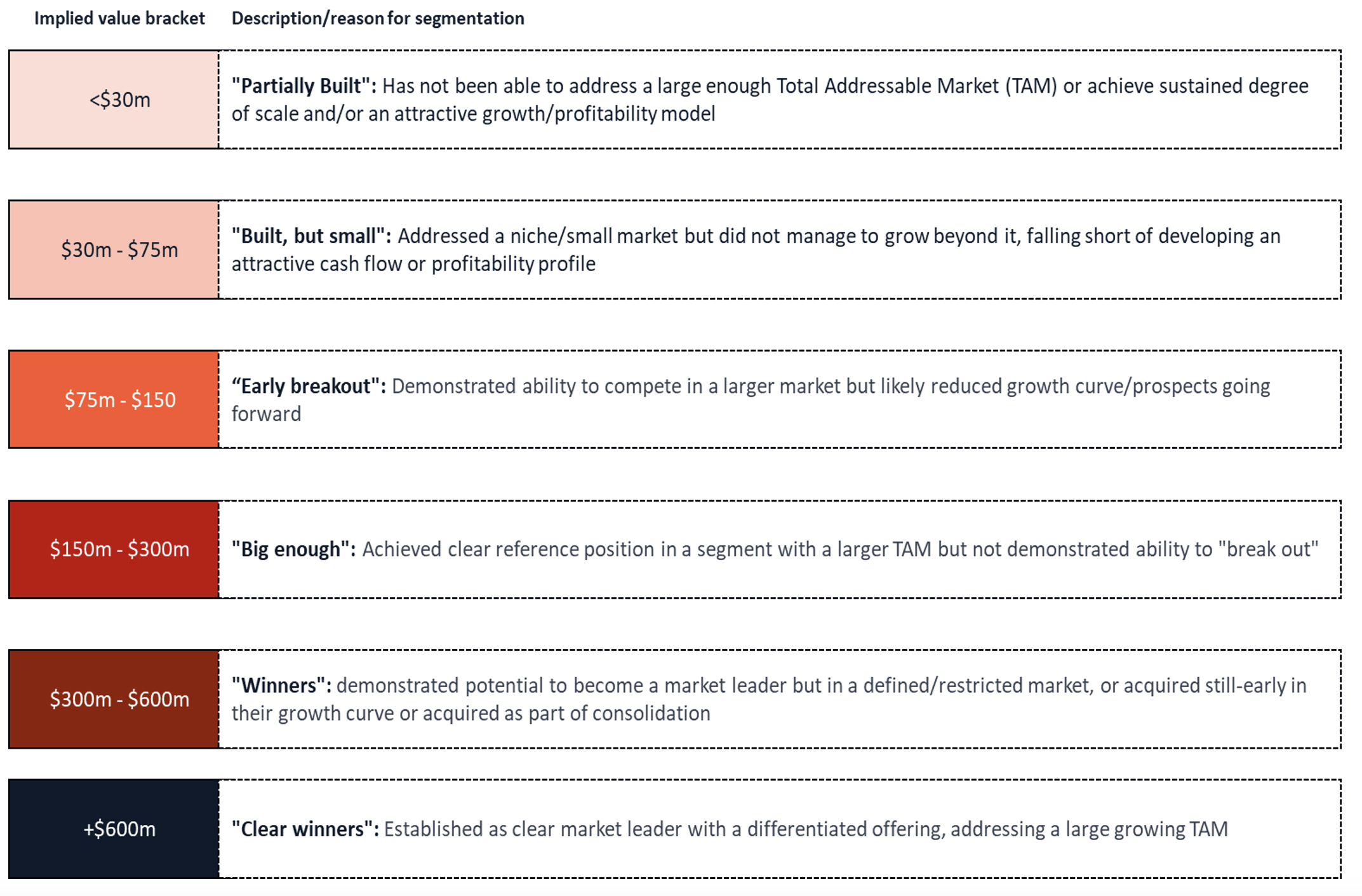

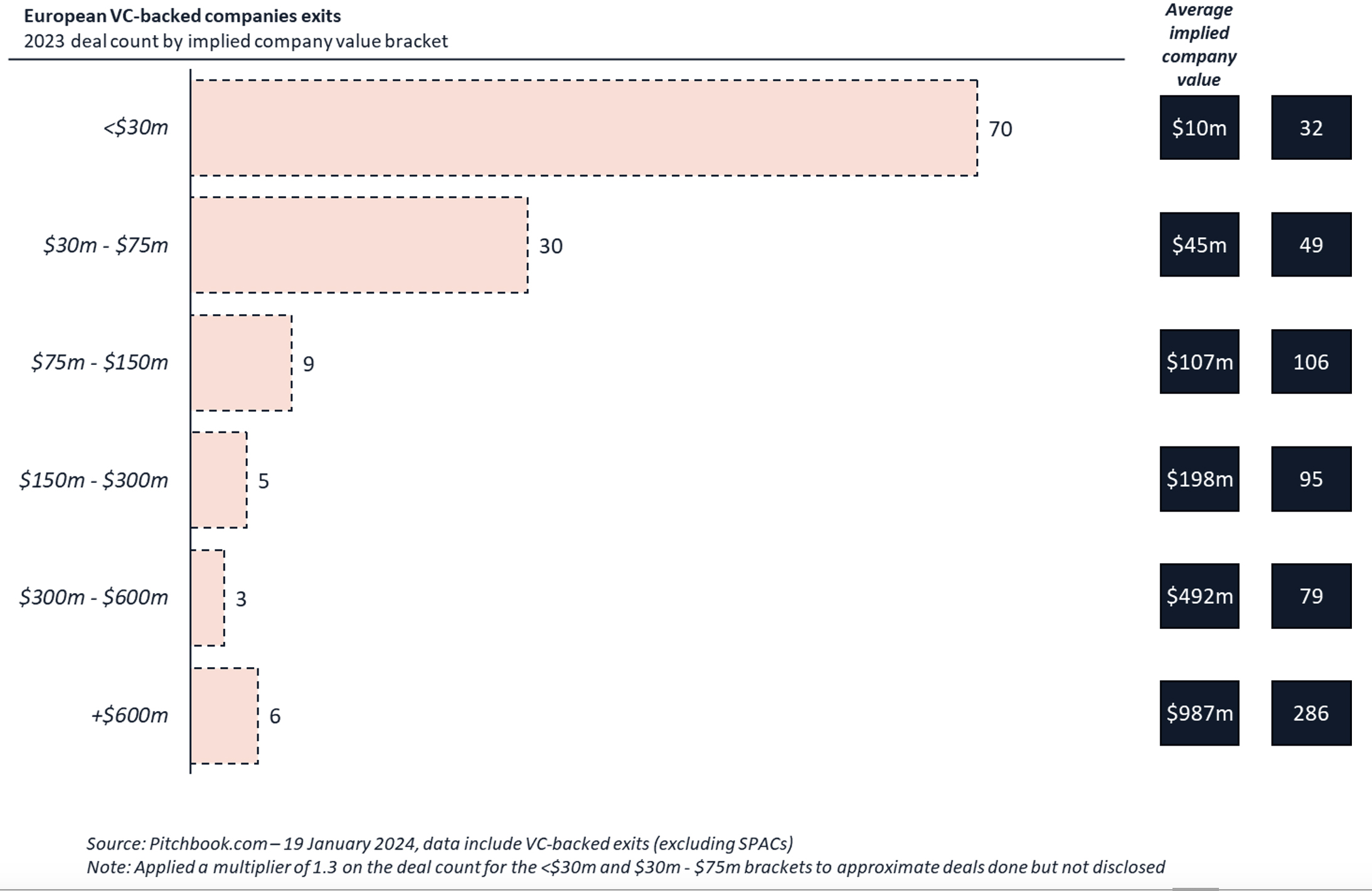

Our analysis delves into the 2023 data of venture capital-backed European companies, encompassing those that underwent ownership changes via mergers and acquisitions, buyouts, or public listings. This encompasses all instances, irrespective of the acquirer’s location or the market of the listing. The data segments according to the implied exit valuation, offering insights into the varying development stages of these companies.

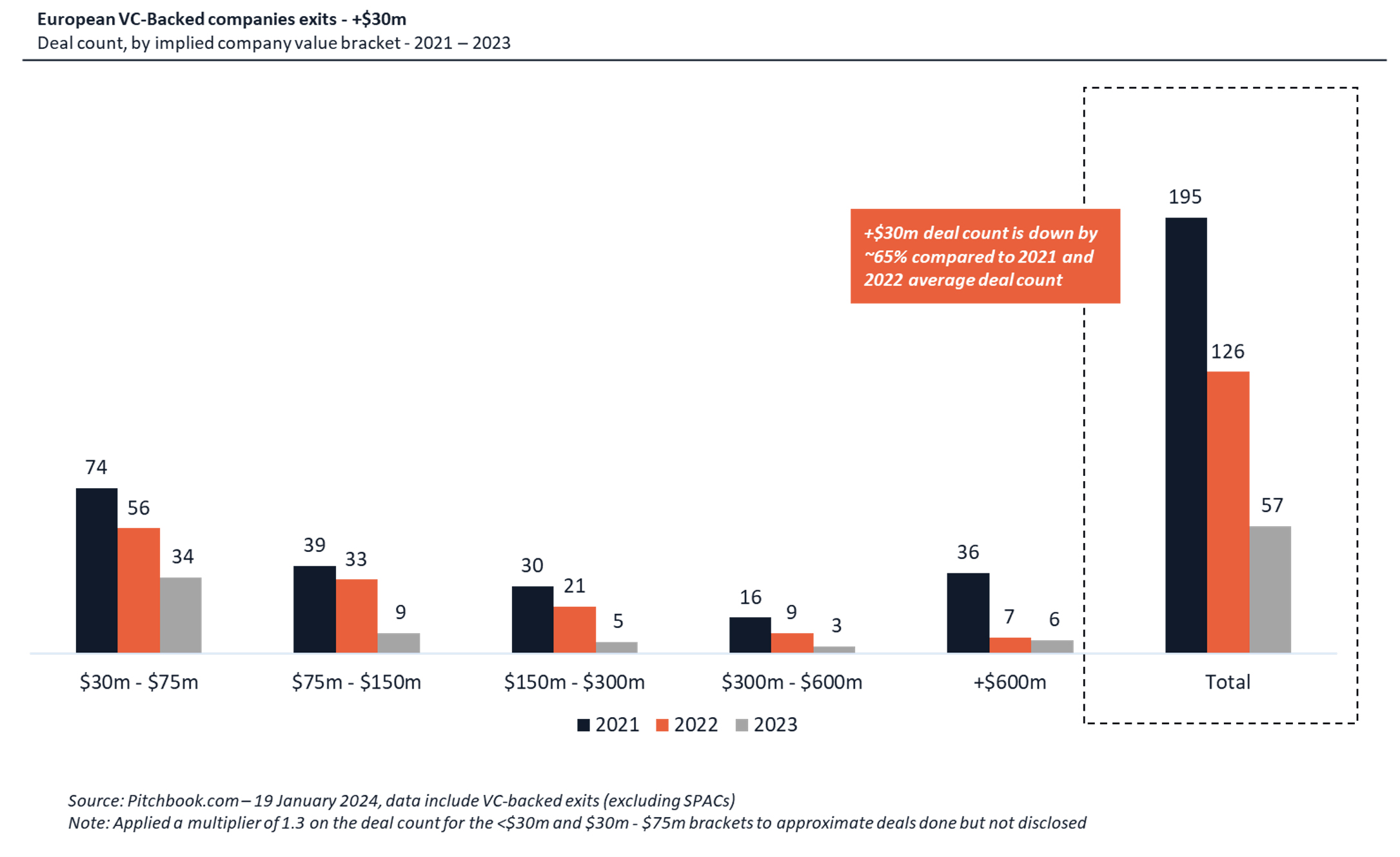

For many venture investors, an impactful exit is one surpassing the $30 million mark – based on our segmentation deals below $30m tends to be much smaller than $30m. In 2023 only 60 exits had an implied valuation upwards of $30 million. Only six remarkable deals exceeded $600 million, predominantly in the healthcare sector, including notable transactions like BioNTech’s acquisition of Instadeep.

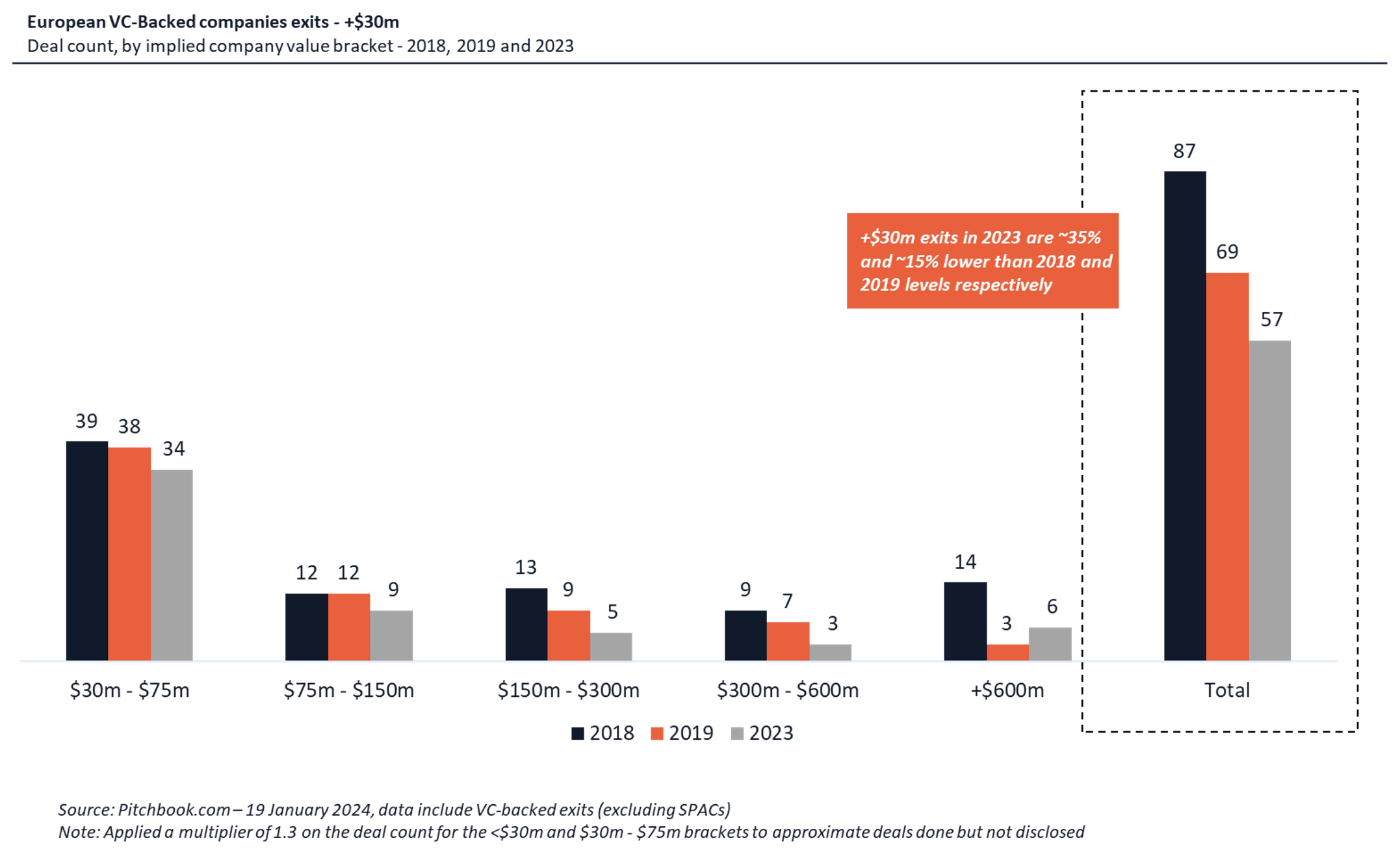

When comparing the number of exits with a value exceeding $30 million from 2023 with those from 2021 and 2022, this figure plummeted by approximately 65%. More interestingly, the statistics align closely with 2018 and 2019, suggesting a reversion to a more sustainable pattern of 60-100 significant exits per year in the European tech and growth sectors.

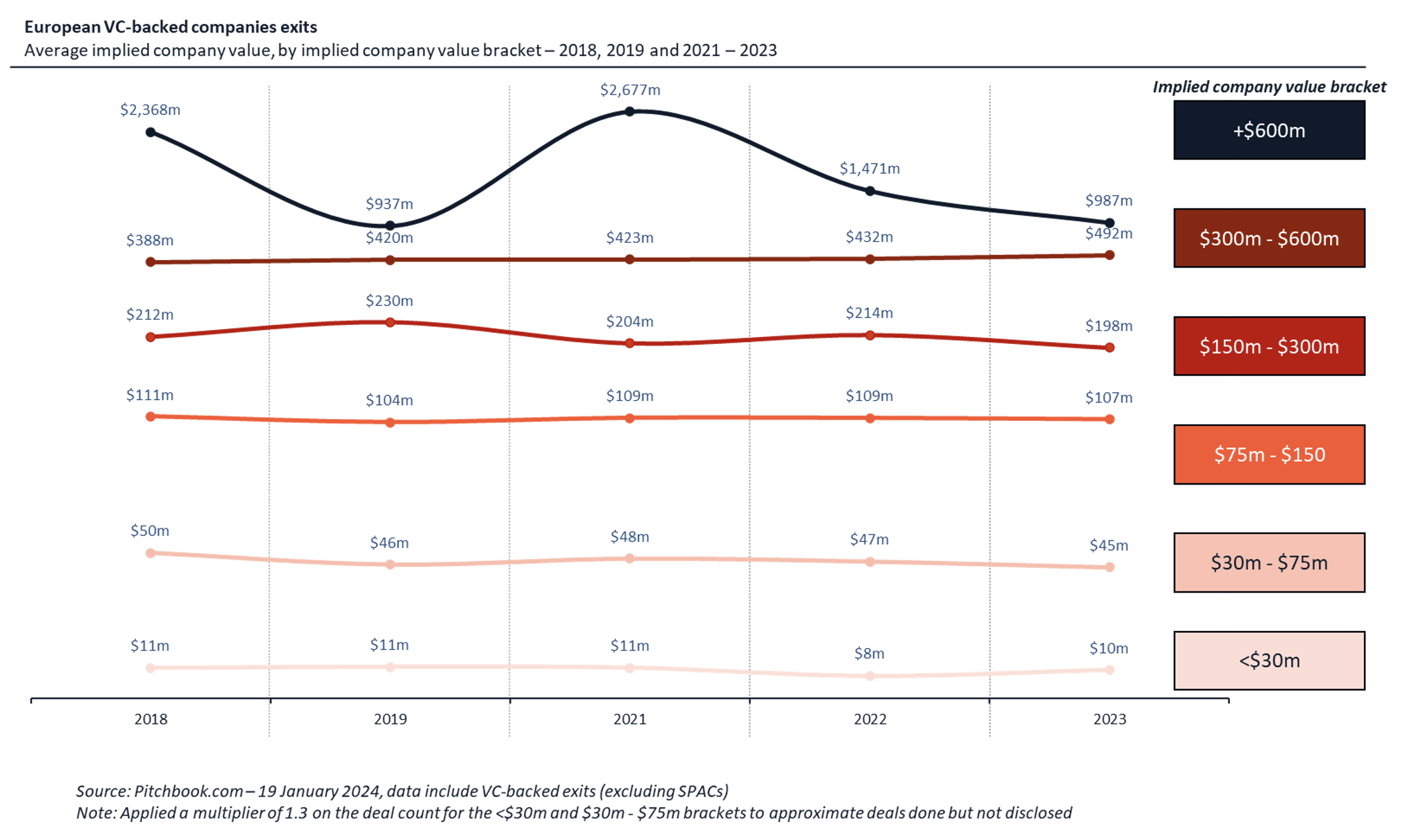

Notably, the implied valuations for exits under $300 million have shown consistent trends from 2018-2019 through 2021-2022 and into 2023. Beyond a higher volume, in 2021 and 2022, the venture capital landscape was characterized by a marked trend where companies were frequently ascribed higher implied value brackets. This phenomenon indicated that investors were attributing to these companies a more advanced stage in their development trajectory than might have been the case in previous years. This optimistic assessment, driven by a buoyant market environment, led to valuations that suggested these firms were further along in their growth and development stages than they might have realistically been.

Following 2023’s slowdown, in 2024, we are likely to see the following for each bracket:

- $30m – $75m: Significant activity is expected in the $30-75 million range, indicating both opportunity and work ahead for “Partially Built” companies.

- $75m – $150m: Exits above $75 million should be celebrated, though tempered by realistic expectations. From a portfolio perspective, a few might be in the $75-150 million range.

- $150m – $300: Exceeding $150 million will be challenging, with success in the $150-300 million spectrum hinging on multiple factors.

- +$300m: Anything beyond this would be considered a clear “win” with current market trends.

2024 and 2025’s investment landscape will be more akin to 2018 and 2019, with a 60 – 100 pattern of +$30m exits and exits requiring strategic planning and foresight, often based on decisions made 9 to 12 months prior. VCs should be realistic about where their portfolio fits in such an environment and plan accordingly.

Learn more about us.

View our transactions.