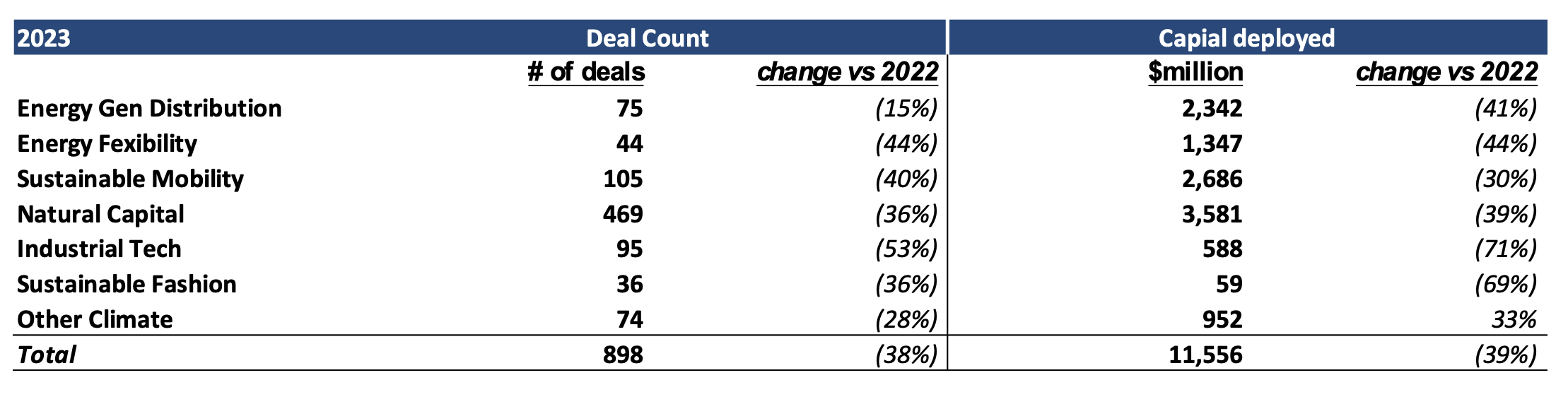

2023 proved a challenging year for the climate vertical. European climate investments succumbed to the broader market downturn, experiencing a 39% drop in deals and capital, in line with the rest of the European market. Whilst severe, this decline is less acute than the US, where VC funding plummeted by 60% year-on-year.[1]*

The ‘Other Climate’ category, primarily encompassing Space Tech and Earth Observation, was the only sector to see an increase in investment, with a 33% rise in capital inflows due mainly to an increase in deal size in the category. This upward trend was supported by two key factors. First, the rapid development of AI technology has been a significant driver, significantly enhancing the sector’s expansion and innovation. Additionally, the ability of defense tech companies to secure long-term government contracts indicated a promising avenue for sustained growth, particularly beneficial for space infrastructure firms in the current market environment.

The ‘Other Climate’ category, primarily encompassing Space Tech and Earth Observation, was the only sector to see an increase in investment, with a 33% rise in capital inflows due mainly to an increase in deal size in the category. This upward trend was supported by two key factors. First, the rapid development of AI technology has been a significant driver, significantly enhancing the sector’s expansion and innovation. Additionally, the ability of defense tech companies to secure long-term government contracts indicated a promising avenue for sustained growth, particularly beneficial for space infrastructure firms in the current market environment.

Overall, deals exceeding $25 million were more resilient than the broader market in terms of deal count, declining by 25%. However, the average deal size in this range fell, causing the capital invested in larger deals to decrease by over 40%. Overall, investors focused on companies with lower risk and more established trajectories as they became more cautious and selective, leaving fewer opportunities.

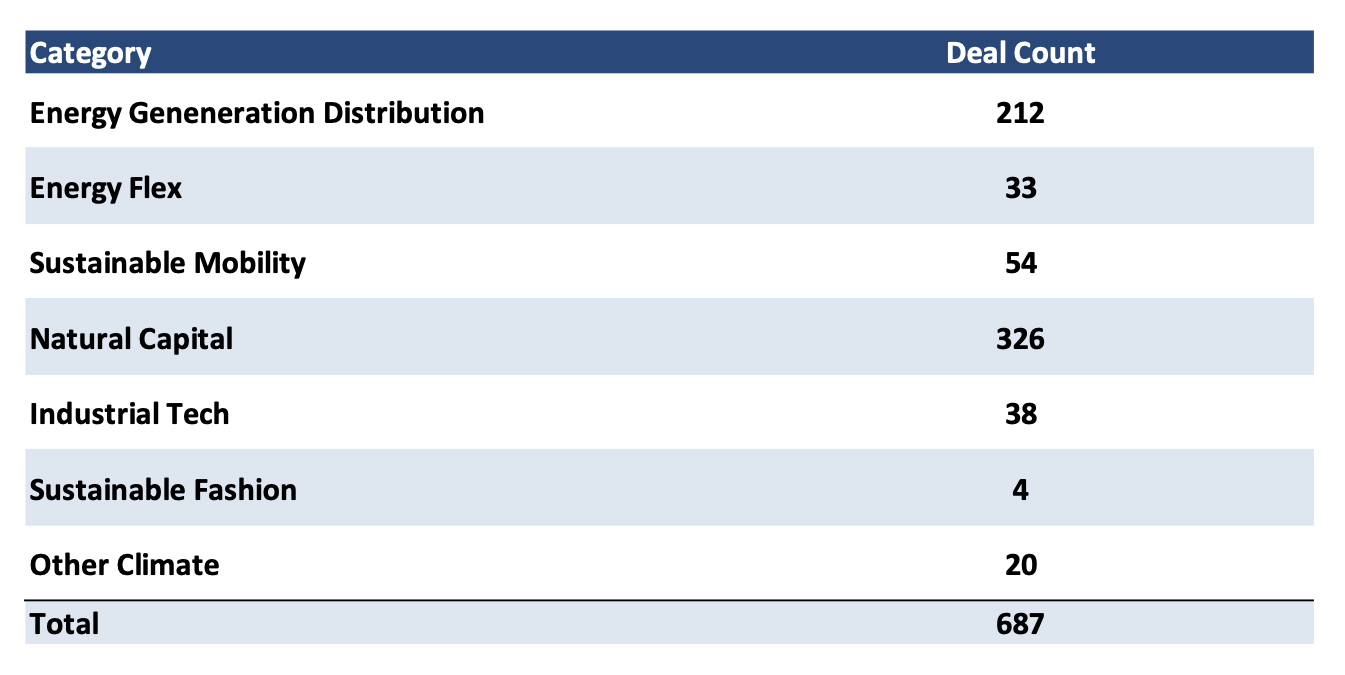

M&A market

While fundraising remained challenging throughout the year, strategic players drove a significant uptick in M&A activity in 2023. With financing more expensive, strategic players have become increasingly competitive in acquiring long-term renewable energy production assets. DAI Magister recorded 687 deals in 2023, with nearly 50% and 30% of deals in the Natural Capital and Energy Generation Distribution segments, respectively.

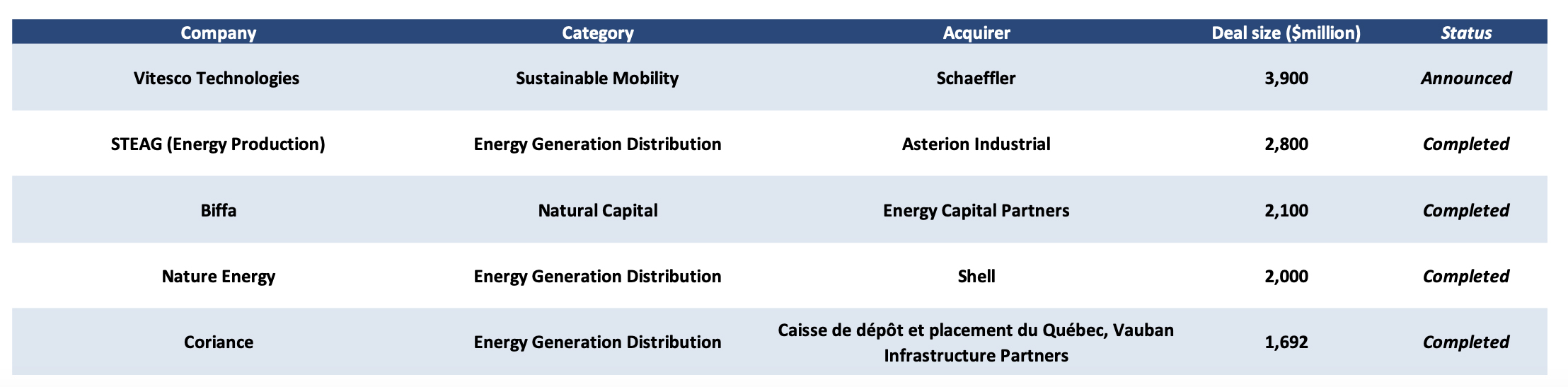

The five largest deals were in Energy Generation, Natural capital and Sustainable Mobility.

The merger in progress of Vitesco Technologies and Schaeffler aims to create an EV supplier giant as the two companies have similar technology offerings in the e-mobility space. It will enable Schaeffler to operate a clear shift to electric motors thanks to Vitesco having significant order traction in its electric-drive division.

Trends for 2024

The European Green Deal budget currently stands at EUR 50 billion, equivalent to 0.3% of the European Union’s GDP. However, this amount is nowhere near enough to meet the EU’s ambitious 2030 climate target, estimated to require approximately 2% of GDP, with a share of public investment between 0.5% and 1%. We anticipate a substantial investment increase to EUR 180 billion between 2024 and 2030 to better align with the EU’s climate objectives.

In the aftermath of COP28, many funds also announced dedicated climate funds to expedite the transition and get back on track with climate objectives, one example is the new $30bn Alterra fund design to support the energy transition. We expect a cascade of positive impacts as the accumulated public and private capital gets deployed and government support across various sectors ramps up throughout 2024.

Clean energy to dominate investment landscape

Energy sector investments totalled approximately $3 trillion in 2023. What’s particularly noteworthy is that over 50% of these investments were channeled into clean energy initiatives. This trend is poised to persist in 2024, further bolstered by the European Union’s unwavering and increasing policy support.[2]

While previous clean energy investments predominantly focused on infrastructure development, we see the next wave pivoting towards software-driven solutions that optimise energy systems and streamline operations through AI, Big Data, and IoT.

Additionally, with the proliferation of renewable energy, we can expect continued interest from investors in Energy Storage Solutions, embodied in 2023 by the $907m round of Verkor, a high-density cylindrical Li-ion battery producer. The development of new lithium chemistries and alternative storage technologies, the latter with the ability to cater to a significant portion of the medium-term storage demand, will drive increased appeal to companies with performing solutions, as the industry has clear tailwinds in Europe such the volatile wholesale prices and supportive public policies.

Hydrogen

We anticipate larger transactions and investments as hydrogen projects move from initial pilot projects into a growth and scaling phase. Projects will be strategically based close to relevant off-takers across Europe and laser-focused on meeting offtakers’ needs in terms of molecule type. Specific regions in Europe, like the Nordics and Scotland, will leverage their regional advantages and benefit from government support.

While established projects graduate to growth and look to scale, more nascent projects like Waste2H2 and Turquoise Hydrogen will still need to prove their bankability to potential investors to attract the necessary funding and navigate to the next phase.

Carbon Capture and Storage (CCS)

Carbon offsetting has merits, but it alone cannot suffice to meet the challenging goal of limiting temperature increases to 1.5 degrees.[3] Carbon Capture and Storage, particularly when used to generate synthetic fuel, is emerging as a critical avenue for meeting this target.

Until now, we’ve seen limited adoption of CCS technologies due to a lack of scalability of CCS projects, with only 0.1% of carbon dioxide removal from the atmosphere attributed to these technologies. However, a potential reduction in technology costs by a factor of six will make CCS projects more scalable and attractive for investments.[4] With scalability barriers gradually fading, we anticipate a surge in investments in this crucial vertical in 2024.

Precision agriculture

High levels of food insecurity will serve as the key driving force behind increased investments in precision agriculture in 2024. In a world grappling with conflicts, extreme climate events, and surging fertilizer prices, nearly 800 million individuals find themselves plagued by chronic hunger and varying degrees of food insecurity.[5] With high levels of food insecurity expected to persist, the precision agriculture market is predicted to reach $14.61 billion by 2027, growing at a 13.12% CAGR between 2022 and 2027.[6]

However, the transition to precision agriculture has its own set of challenges. Cost remains a formidable barrier, with high-tech sensors and software often out of reach for small-scale farmers. Connectivity woes also plague rural areas, and considerable knowledge gaps will continue to exist, requiring targeted training and education to empower farmers to harness the full potential of these tools.

Alternative proteins

The alternative proteins market is poised for significant growth, fueled by several key drivers. Lifestyle shifts and the pivotal role of these proteins in combating climate change are among the primary factors propelling this growth, despite the softening in the last 18 months due to inflation. Alternative protein is not a passing trend; it has become a significant focus for investors. This goes beyond simply altering dietary preferences; it’s a quest for sustainable alternatives to conventional livestock farming, responsible for 15% of global greenhouse gas emissions.[7]

Bloomberg projections indicate that the global market for plant-based dairy and meat alternatives is set to exceed $160 billion by 2031. This substantial growth reflects a notable transition towards sustainable and environmentally friendly protein sources aligned with international efforts to curb emissions.[8]

Strategics have a significant role to play

In today’s climate technology landscape, many firms still operate on a relatively modest scale. Considering the current capital constraints, larger strategic companies are well-positioned to acquire smaller firms that have achieved a certain level of growth and strategic value.

Within the hydrogen sector, strategic investors are expected to channel their capital into projects with commercial ties to their operations. Conversely, infrastructure funds, sovereign wealth funds, and project developers like Fortescue will adopt a more selective approach in a landscape brimming with alternative investment options for hydrogen production.

In the earth exploration space, leading technology companies will ramp up their investments in AI-powered solutions, aiming to enhance the efficiency of mining operations throughout the value chain. Tech giant Microsoft has partnered with BHP, utilising advanced AI and machine learning to enhance copper recovery processes at the company’s Escondida mine in northern Chile.[9]

The partnership leverages BHP’s implementation of the Azure Machine Learning operations platform and its use of various Microsoft Azure services, including Azure Synapse Analytics and Azure Data Lake Storage. The seamless integration of these state-of-the-art technologies, combined with the adoption of innovative development practices and work methodologies, has enhanced the efficiency of the mine’s concentrator circuit, which plays a crucial role in extracting and collecting copper minerals from the processed ore.

Mining companies are also set to boost their investments in AI independently of these partnerships. Projections indicate that these investments will surge to around $218 million by 2024, a significant jump from the $76 million allocated in 2019.[10] The continued uptrend in investments stems from the growing need for improved efficiencies in light of challenges like declining ore quality, the increasing complexity of reaching new, often remote deposits, and the mounting operational costs within the industry.

Conclusion

The market dynamics are likely to remain under pressure for 2024. This is reflected by a demand-supply ratio that is at a 10 year high, especially at the late stage with of $1 funding available to $3.24 demanded.[11]** However, the reality is, the European market currently has a significant amount of dry powder. Since 2021, VCs have raised an accumulated $50bn in new local funds; and if it’s any indication, State of Tech Survey reveals that 87% of European VCs anticipate a rebound in the deal volume in 2024 versus 66% when asked last year.

It is undeniable that as the market unlocks, the underlying tailwinds of Climate tech companies in key verticals mentioned above, are prone to make this vertical increasingly attractive to investors.

Learn more about us.

View our transactions.

*[1] Pitchbook, includes deals completed and deals announced/ in progress. Ranking is based on disclosed deal sizes

**[11] Pitchbook