Today, when VCs most need successful exits, the exit market has returned to a ‘challenging normal.’ From the highs of 2021-22, exits exceeding $100 million have fallen 50% to 2018-19 levels. While this is still considerably higher than the previous decade, to investors and founders this surely feels like a sharp decline. This reset, however, should come as no surprise. Everything reverts toward the mean, and with high interest rates and public companies going private due to low valuations amidst economic and macro uncertainty, achieving successful exits now requires thoughtful and sustained planning to maximise value.

Achieving a successful VC exit has generally always meant M&A. Other than 2021-22 and the internet bubble period in the early 2000s, 80%+ of successful exits have been through M&A — a 100% sale where shareholders get cash or full liquidity, rather than IPO. In the current environment, M&A typically means a sale to a larger strategic buyer as opposed to private equity. While private equity buyers have become far more prominent over the last decade, it is inherently true that a strategic buyer able to leverage a target’s footprint, technology or capabilities should always be able to pay a higher price.

This post is part of a series exploring what effective planning means for a strategic M&A sale, how companies and founders should think about planning, and some of the lessons we have learned over 25 years of handling such exits.

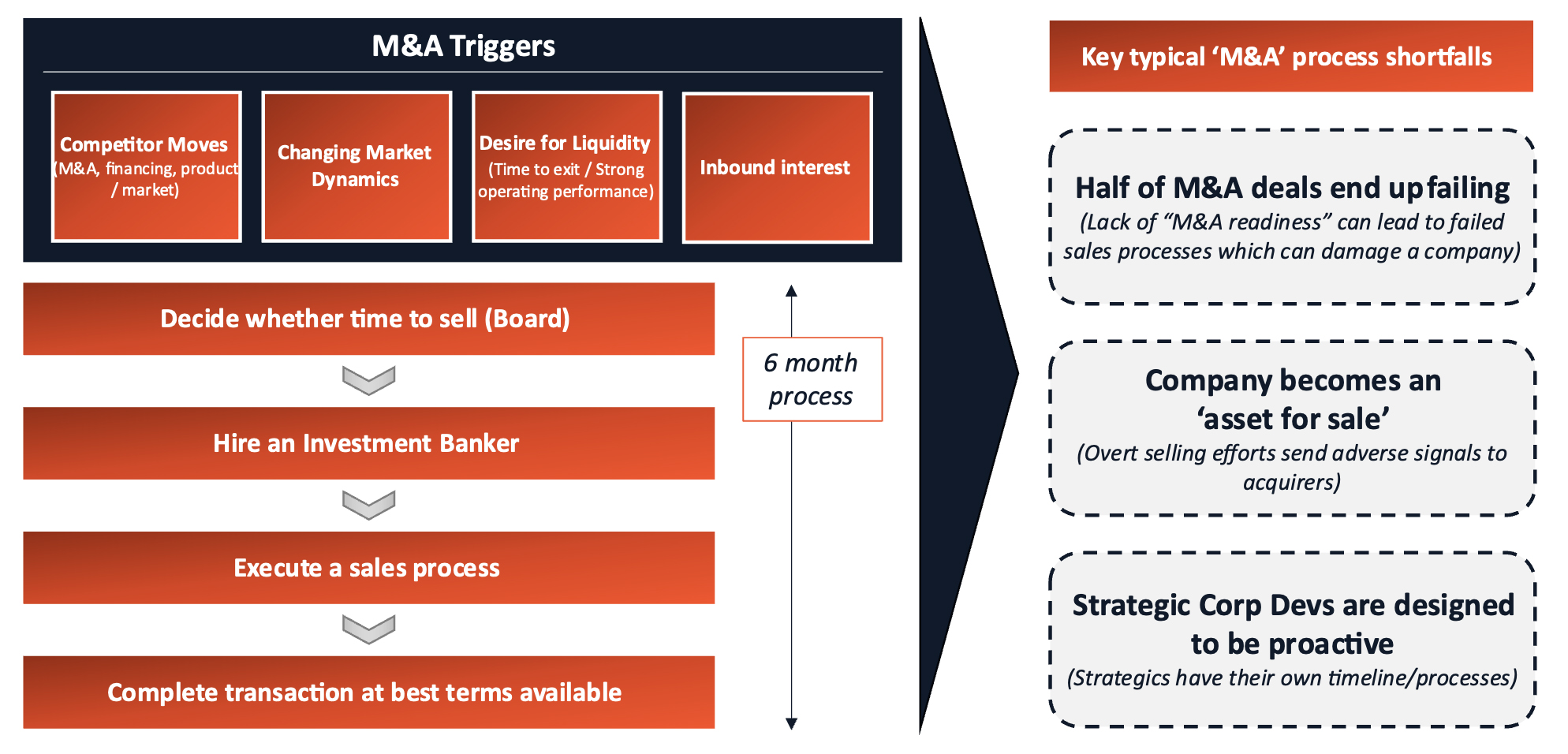

Success in an M&A exit is down to two factors: certainty and price. The conventional wisdom is to hire an M&A banker, prepare a selling ‘book’ and market the business for sale. However, roughly half such efforts fail. It bears repeating for emphasis: 50% fail. And often where they ‘succeed’ the outcome is either a deal at a lower price or one that closes amidst uncertainty. Our experience shows that this approach is just as likely to result in a lower price and less certainty as it is to achieve a quality outcome.

The reason for this is that a company put up for sale immediately becomes an ‘asset’ being sold. Prospective buyers must decide within a matter of weeks whether to pursue a business they may not know well. Being less familiar with a potential target increases the risk from the buyer’s point of view whether perceived or real. This kind of ‘rush to a deal,’ rather than guaranteeing ‘competitive tension,’ can just as easily lead to buyers being unable or unwilling to engage seriously. Even when they do engage, it frequently leads to buyers evaluating the asset ‘as-is’ rather than having the time to understand and appreciate the full potential value of the opportunity. This is an even more pressing issue for fast growth companies that are disrupting industries where the financial profile of the company has yet to reflect its full potential and value.

The Solution: A Two-stage M&A Process

To address these challenges, our M&A work increasingly focuses on 2-stage exit processes. We developed this approach years ago as an outgrowth of a class our CEO, Victor Basta, had taught at INSEAD called “Preparing for a Successful Exit,”. We have since integrated this playbook into our M&A work across over 300+ successful exits so far, optimising for value and certainty in every case.

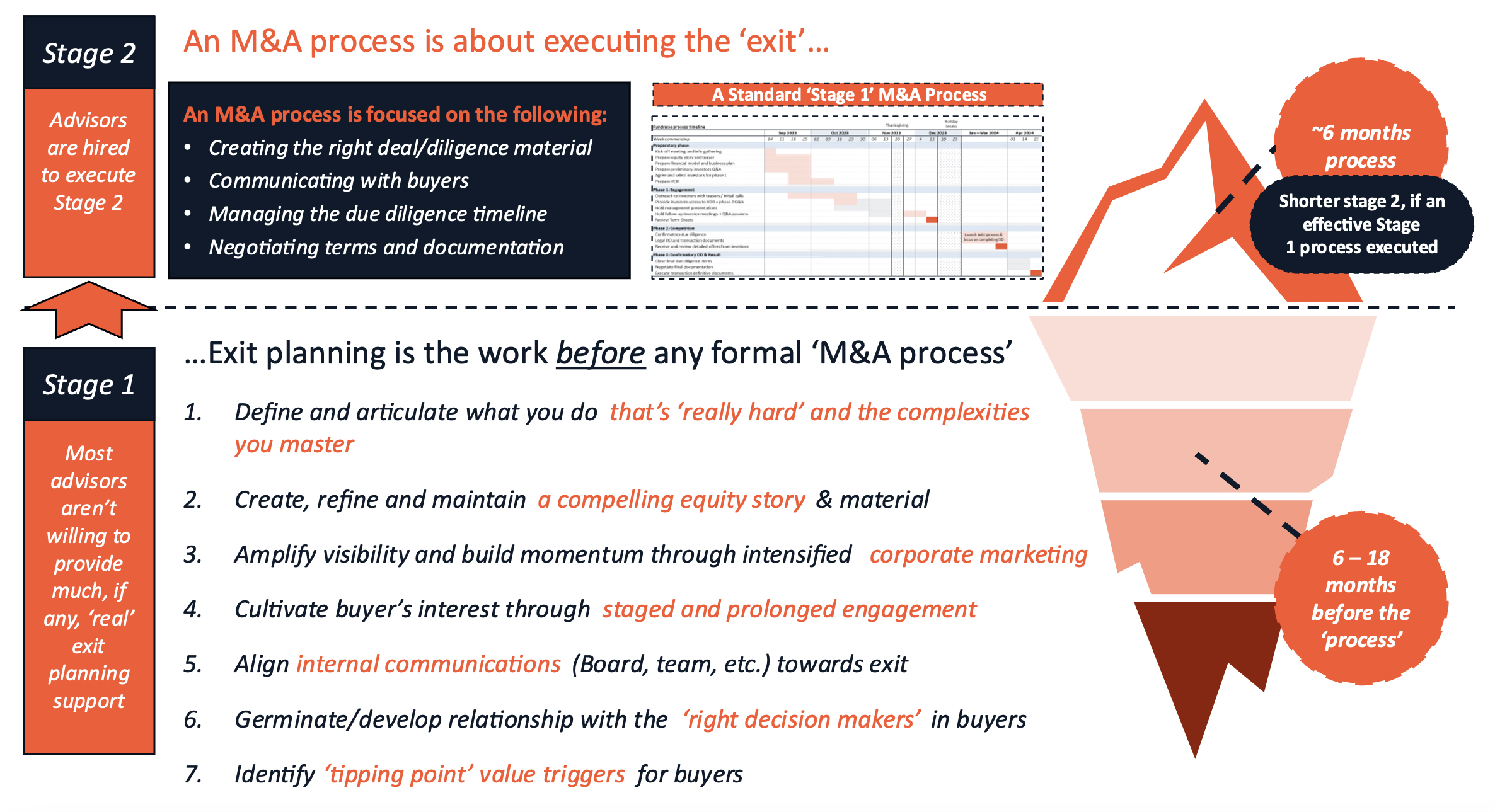

The first stage, which we call ‘Stage 1;’ involves structured, sustained exit planning over a 6-18 months period to lay the groundwork before a company engages in a traditional formal M&A process (‘Stage 2’). Key to this succeeding is that Stage 1 is largely invisible to the general market; a company is not reaching out to dozens of buyers with a for-sale process and materials, requiring a response within a defined time-frame. The simple objective is to achieve a higher price with greater certainty by cultivating buyers ‘quietly’ in stages, developing and communicating positioning, and proactively addressing potential deal roadblocks well before any strategic buyer is asked to bid. In short, the objective is that a company ends up being bought, rather than sold.

During Stage 1, the company is never positioned as being for sale. Instead, relationships are built with buyers around partnerships or strategic deal, developing interest over time. This enables us to not only introduce the company to buyers but also gain insight into buyers’ perspectives, decision-making processes, key decision-makers, and acquisition appetites. Stage 1 also often provides much clearer visibility on optimal exit timing, driven by the objectives of the most suitable buyers.

In commercial terms, think of Stage 1 as ‘marketing’ and Stage 2 as ‘selling.’ Stage 1 is where the company tells its story to the market, educates buyers about its operations and the opportunities it is unable to fully capitalise on as a stand-alone entity, and cultivates genuine interest from a core group of seriously interested strategics. Simultaneously, it engages with these potential buyers to understand their acquisition appetite and probability to transact. Stage 2 is the intense sales effort built firmly on a rigorous foundation laid in Stage 1.

Stage 1 Builds Momentum Towards an Accelerated Stage 2

Another dimension of Stage 1 is repetition of key equity value points across multiple marketing channels. We like to think of this in terms of marketing’s “Rule of 7”: someone typically needs to hear a message at least 7 times before fully internalising it. As applied to planned exits, this means a qualified buyer often needs to hear the same key attributes repeatedly to fully ‘get it,’ requiring time and patience to achieve. The reward is a group of engaged potential buyers who understand and appreciate a company’s future opportunity and have a clear view of the value of an acquisition well before they are asked to ‘make an offer.’

Stage 1 also reveals more opportunities than a traditional Stage 2 M&A process ever could. In fact, a traditional M&A process is designed to reduce the number of buyers, not increase it. It typically starts with a large buyer group, a requirement for indicative bids relatively quickly, then rapidly winnowing down to a few parties. Competitive tension tends to decline as the deal progresses, placing a greater burden on the seller to maintain momentum. As buyers drop out of the process, the seller’s negotiating position weakens, allowing the remaining buyers to dictate the outcome.

The “bought, not sold” approach in Stage 1 achieves the opposite; thoroughly exploring strategic fit with a broadening group of potential buyers without the pressure of looming bid deadlines. After investing time and resources in building conviction and alignment with these potential buyers, a company enters a structured M&A sale process (Stage 2) with a strong tailwind of momentum and engagement from buyers who are genuinely ‘at the table.’

This pre-qualification and cultivation of buyers helps to maintain competitive tension throughout the process. The company negotiates with counterparties who have a clear strategic rationale, fully understand the opportunity and have a strong desire to complete a deal. Real competitive tension develops, shifting the burden of maintaining momentum to buyers motivated to move quickly and decisively to secure the asset.

In some cases, an intensive Stage 2 in isolation is the right answer e.g. when there is a defined group of buyers already well known to the target, or where the sale is catalysed by a serious approach from a qualified party. But too often a Stage 2 process is simply triggered by default, i.e. when VCs want to exit, they hire a banker to go sell the company.

A Two-Stage Exit Process Delivers Greater Certainty and Higher Value

In today’s ’reset’ VC exit environment, a thoughtful and proactive approach based on a two-stage exit planning process is more critical than ever. The days of ‘easy money’ and sky-high valuations are behind us, and serious buyer engagement is now essential to achieve certainty of a positive outcome at premium multiples.

Founders and investors seeking the best outcomes need to start early, be systematic in their approach, and partner with experienced advisors who can help navigate the complexities of the exit process. Our decades of handling these two-stage exit processes is built on a complete planning framework refined over 300+ successful transactions, providing what we believe is a unique playbook to maximise value and certainty.

In future posts we’ll explore in more detail the ingredients that go into successful company positioning and buyer cultivation in Stage 1, and how that can drive higher value in a more rapid, more certain Stage 2. We strongly believe that with the right approach and thoughtful execution, investors and founders can achieve outstanding exits that deliver exceptional, and timely, returns to their stakeholders.

Learn more about us.

View our transactions.