Europe’s start-up ecosystem has grown by leaps and bounds in the last decade. Yet it risks being stalled by the lack of later stage financing for Europe’s tech industry, which has hardly budged in five years. The result is a yawning, and growing, chasm between the number of ‘grown up’ European tech companies eligible for late stage growth money, and the capital available in Europe to back them. We believe it’s already hurting growth prospects for European tech, while opening a hugely valuable gap in the funding market, which new funds could fill profitably.

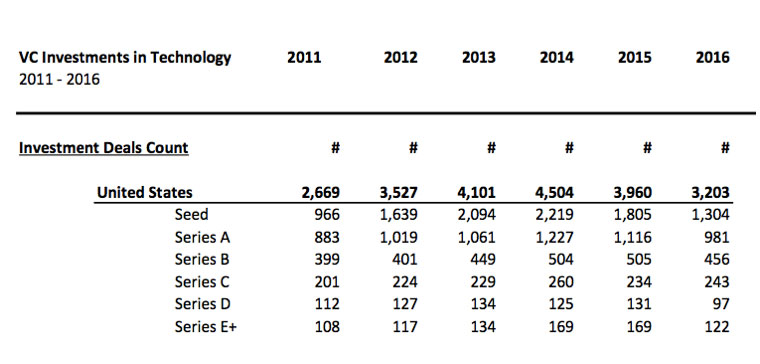

US FUNDING MARKET IS BRUTAL, BUT CAPITAL IS AVAILABLE AT ALL STAGES

Our analysis suggests a clear ‘rhythm’ to the US funding market:

- Over the past five years, about 1,000 companies get Series A funding annually.

- Natural selection means about half of these raise a Series B round, while a quarter go on to also raise a Series C round. The market may work ruthlessly, but at least it works logically, and capital is available at every stage.

- Finally, 100-150 companies each year graduate all the way to a Series E round or later, usually a mix of pre-IPO home runs and those running expensively towards mediocre success.

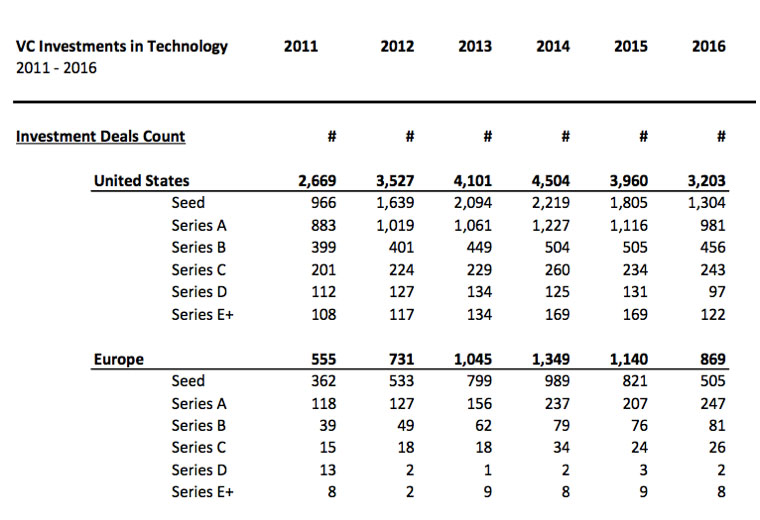

EUROPEAN FUNDING HAS TRANSFORMED, BUT LATER STAGE ROUNDS STILL BARELY EXIST

- European Series A rounds have jumped from 100/year to 250 in the five years to 2016, a huge jump in such a short period, and indicative of the support tech is receiving across Europe.

- The jump in available funding is fuelling a generation of founders to build disruptive, often scalable companies that are competing internationally from Europe.

- Given Silicon Valley is 40+ years old, for Europe to already be at 25% of the US’ level of Series A financings, in five short years, is nothing short of extraordinary.

- However, all the energy driving the start-up eco-system is slamming against a literal wall of (non)-funding beyond Series B rounds.

- In the US, there were 462 Series C and later rounds. The equivalent number in all of Europe in all of 2016? Just 36. While European Series A is 25% of the US total, Series C and later is just 7% of US levels. This is for the entire European continent.

And lest you think this is a one-time or temporary phenomenon, unfortunately the table above shows the lack of later stage funding is a chronic affliction. There have been maybe 20, 30, or slightly more such rounds in EVERY year since 2011.

Put simply, the later stage funding market in Europe barely exists. Moreover, it is not developing, even as European companies are scaling fast, and internationally.

Why does this exist? We think there are several reasons:

- There aren’t (yet) enough companies deserving of Series C rounds – there is some truth to the fact the pool of qualified companies remains shallow in Europe. However, companies are scaling faster today than ever before, and this ‘lack of supply’ will change in only one to two years’ time. It takes that long to raise a later stage fund targeting these companies, so arguably its already very late to address the impending jump in quality supply of companies.

- European companies get sold much earlier than US companies, which partly explains the point above – undoubtedly this is true, European companies are snapped up at earlier stages of development than many US competitors. Because of smaller fund sizes and a more cautious approach, many European investors value a €100m exit in the same way US investors would view a $250m exit. And it’s not as simple as ‘lesser ambition;’ many European investors have seen companies fail as they internationalise, and prefer to take the money and leave the buyer with that risk.

- Capital efficiency is much stronger in Europe than the US, meaning European tech companies need less – Capital efficiency is the discipline to use less capital, and achieve more with it. Regarding European companies, it’s a fair point, the discipline from European investors is different, and often more intense, than US VCs. It’s led to European unicorns averaging $300m of revenue, vs. US unicorns at only $100m+. However, we are talking about Series C rounds, not very late stage capital. Capital efficiency in our view reduces the requirement for very large Series D or later rounds, but it doesn’t eliminate the requirement for a functioning Series C capital market.

- European tech CEOs don’t have the experience to justify later-stage money – This is changing fast. Ten years ago, hardly any European tech CEOs could build the companies and spin the funding stories required to raise $20m+ Series Cs. Today, we reckon 25%+ of European tech CEOs we meet are qualified and able to attract these kinds of rounds.

We see European tech currently racing towards a proverbial wall. Over the next five years, many European companies will qualify for Series C rounds to accelerate their push to become global businesses. We believe they may end up having to grow much more slowly. Having spent years and billions to motivate European founders to take huge risks now paying off, we believe it is nothing short of criminal that the lack of later stage funding now threatens fundamentally that success.