Forget Fin-tech, Cybersecurity or AI, It’s Actually Non-Tech

Europe is much further behind the US in late stage tech investing than it appears. Late stage tech funding is far behind the US, and surprisingly over ⅓ of funding rounds in Europe target non-tech e-commerce or marketplace businesses.

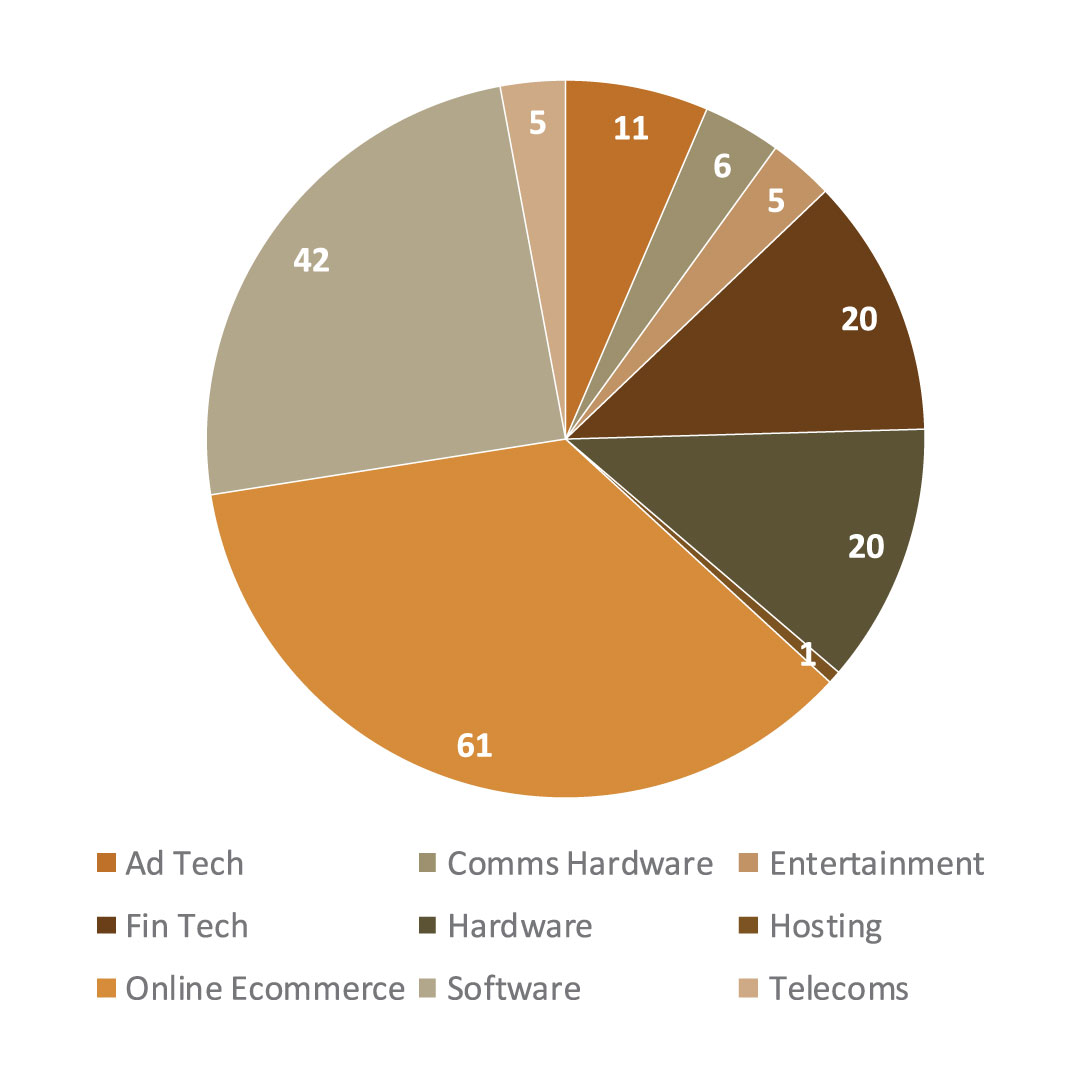

Magister Advisors identified 171 Series C, D and E funding rounds across Europe since 2011, using PitchBook. We categorised the companies by activity, into e-commerce, fin-tech, ad-tech, software, entertainment, communications hardware, other hardware, and telecoms.

It paints a stark picture:

- 61 of the 170+ late stage companies were e-commerce or online marketplace businesses, the biggest category at 35% of the total

- Software was the next biggest group at 42, and this includes ALL of the ‘hot’ sectors like security, artificial intelligence, analytics, and applications for vertical markets

- Fin-tech, perhaps the most hyped tech category in Europe, saw only 20 such rounds

- Ad-tech, another recently ‘hot’ European sector registered only 11 rounds

E-commerce is ‘non tech’

In our view e-commerce or online marketplace businesses are retail businesses first, technology companies second. Most software powering e-commerce can be bought off the shelf, and there is little if any underlying intellectual property (IP). For example, Uber and Lyft’s apps do basically the same thing, and Etsy and eBay operate the same type of marketplace. They use tech, but scale, not core IP, is the differentiator. And to companies like DeliveryHero and Deliveroo, logistics know-how is far more valuable than coding skills.

Only 20 ‘real tech’ companies get crucial late stage money each year

Subtracting e-commerce investments leaves just over 100 financings over five years, or only 20 a year. Let that sink in for a second. Across 27 European countries, 700m+ people and spanning the last five years, barely 20 ‘real tech’ companies a year get serious money to really scale. The late stage tech funding market is functionally non-existent.

No wonder so many European real tech companies get acquired before raising a Series C round. And those that don’t want to sell early often have to shift to the US, with the best evolving into US businesses. The value destroyed for the European tech industry is incalculable.

Late stage European money is funding digital consumer activity, not the next Microsoft

What is happening is late stage money is helping digitise European consumer activity, relying on an accessible base of 700m consumers. As e-commerce reaches 20% of all retail, and with Europe boasting sophisticated payments and logistics, it’s easy to back the next online business selling offline goods more cheaply, or in a slicker way. Plus, the drivers for success in these businesses don’t require an engineering PhD to understand.

However, lets be clear; this is not tech investing, which in our view means backing already sizeable IP-based businesses to accelerate international growth, or expand product offerings. Non-tech investing might be preferable were it not for world-class tech engineering capability across Europe in key areas such as cybersecurity, block-chain, AI or virtual reality, plus a host of more prosaic enterprise software applications. It might also be defensible were it not for the fact Europe’s two big ‘winners’ so far have been SAP and ARM, prime examples of the value of European-created IP. Worse, labelling digital consumer investing as ‘tech’ masks the huge and persistent gulf between the European investment industry and the US.

We understand its a classic ‘chicken and egg’ situation. The tech industry in Europe is very young, there is hardly a local IPO exit option, and the elusive combination of world class business talent and technology know-how (the secret sauce behind all current tech giants, from Apple to HP) is harder to assemble in Europe. As a result, the prospect for creating $1B+ public ‘real tech’ companies in Europe appears structurally more challenging. Contrast with the relatively straightforward alternative of creating an innovative offering distributed via smartphones to hundreds of millions, and the choice is in many cases ‘a no brainer’ in VC parlance.

In our view however there is persistent, and significant bias away from backing IP-based companies. Witness the number of relatively small European tech companies that are acquired for $100m or more each year, and its clear there is plenty of raw material with which to build serious tech companies competing from Europe.

What is to be done?

Given that growth capital flows rationally towards the best risk/reward opportunities, what is to be done to break the ‘vicious circle’?

- Create and highlight role models real tech CEO’s can follow with confidence – It has been decades since SAP IPO’d. Since then enterprise knowledge software company Autonomy briefly scaled to a $10B+ valuation, but its story is no longer perceived as a role model. More recently, it is imperative that we celebrate prominently and broadly the few real-tech companies that have ‘made it’ since, including Criteo, Markit and Ingenico to name a few. There are enough role models around, but they get a lot less publicity than a lawsuit between HP and Autonomy’s former CEO.

- Enable tax-advantaged financing for Series C real tech companies – While national or supra-national ‘solutions’ are never problem-free, the reality is the UK’s EIS programme and similar early stage tax schemes elsewhere in Europe, have contributed to an amazing increase in Series A capital. Endless ink can be spilled on whether all of this capital has been wisely deployed. But as a ‘pump-primer’ its value is undisputed. We believe a similar program promoting IP-based real tech companies raising larger later stage rounds can, over a 5-10 year period, have a similarly dramatic effect. One way would be for a national ‘venture debt’ provider to co-fund larger later stage rounds, requiring less equity capital from risk investors.

- Proactively encourage creation of European late stage funds – European or national money is already very prominent in earlier stage venture funds, so much so that the EIF (the EU’s funding body for VC’s) is often a make-or-break, though challenging, investor in funds that are trying to raise capital. Proactive direction of capital towards later stage funds with specific remit to back Series C and later real tech companies in Europe can quickly accelerate a small group of those companies. By creating one or two new ‘winners’ to take the place of ARM and SAP, the vicious circle can rapidly reverse.

- Encourage senior-level immigration into the EU – Most CEO’s running America’s biggest tech companies are immigrants. Apple was founded by the son of an immigrant. Intel was founded by a Holocaust survivor. And the list goes on. There is no question the same trend will occur in Europe in the coming decades. Immigrants wilful enough to cross borders, who possess an excellent technical education (IIT in India is as good as MIT in Boston), are prime candidates to take critical C-level leadership positions in later stage European companies. And today that flow can be augmented by European entrepreneurs willing to return to Europe, given US immigrant sentiment. Attract an unfair share of these returnees, and in a decade European late stage tech will be transformed.

The funding gap otherwise will only get worse

We reckon the timing is now to take key steps to create a functioning Series C funding market for European real tech. Many Series A and B funded companies are graduating to the stage where €20m+ Series C rounds are necessary if they are to scale independently. At the moment we see many opting for ‘premature’ M&A exits, when at least some should remain private and build more value before selling.

Everyone (everywhere) loves a €100m cash M&A exit before a large Series C funding round. That is, until they experience the value of creating a €1B+ value company by raising that bit of additional later stage capital that causes company value to accelerate.