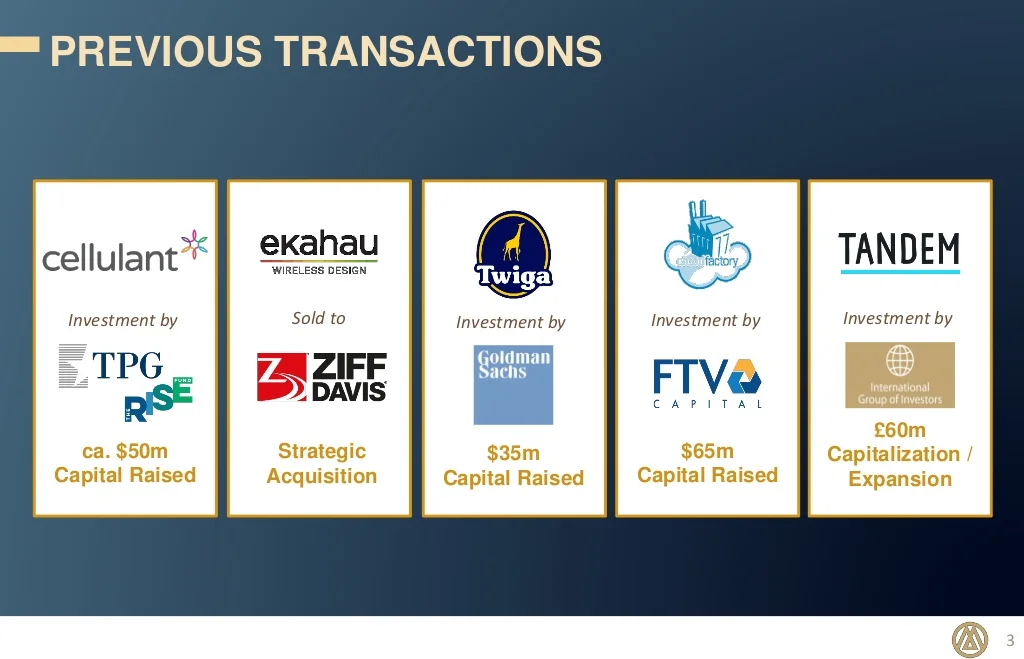

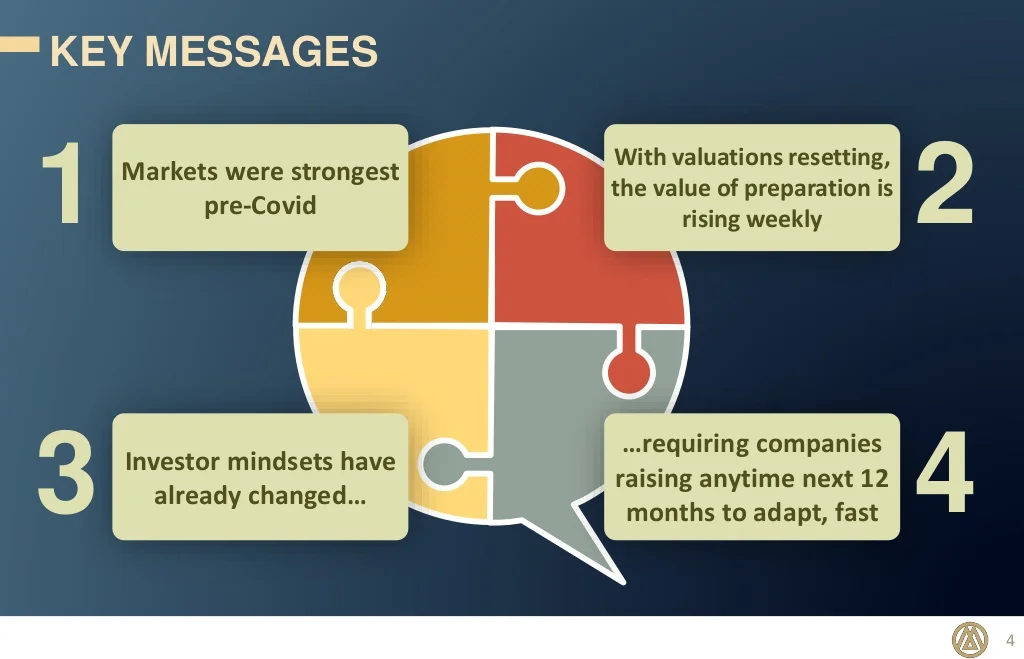

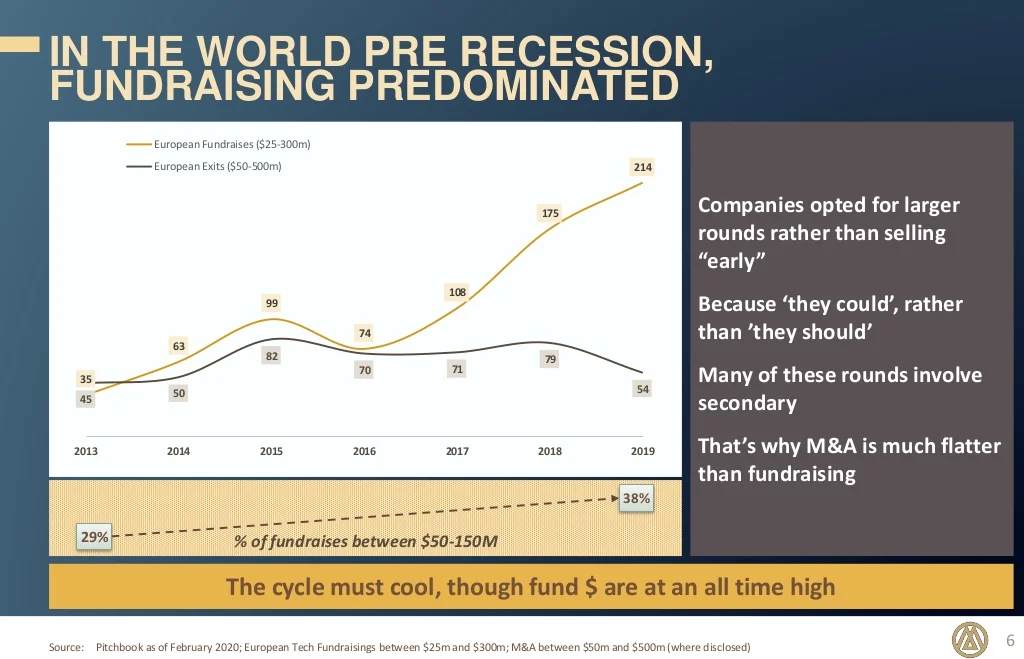

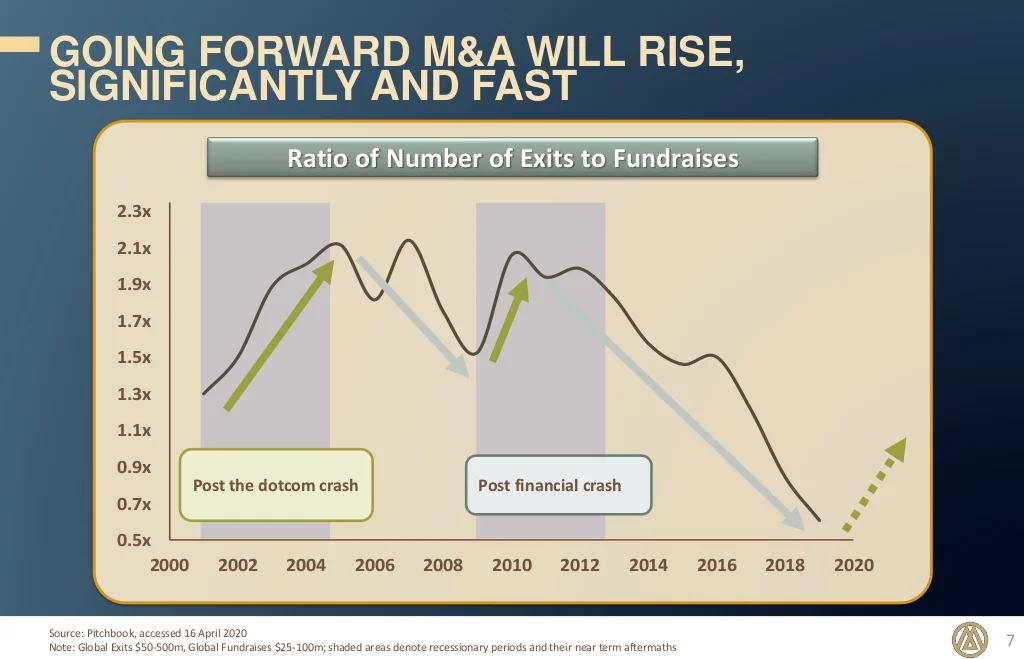

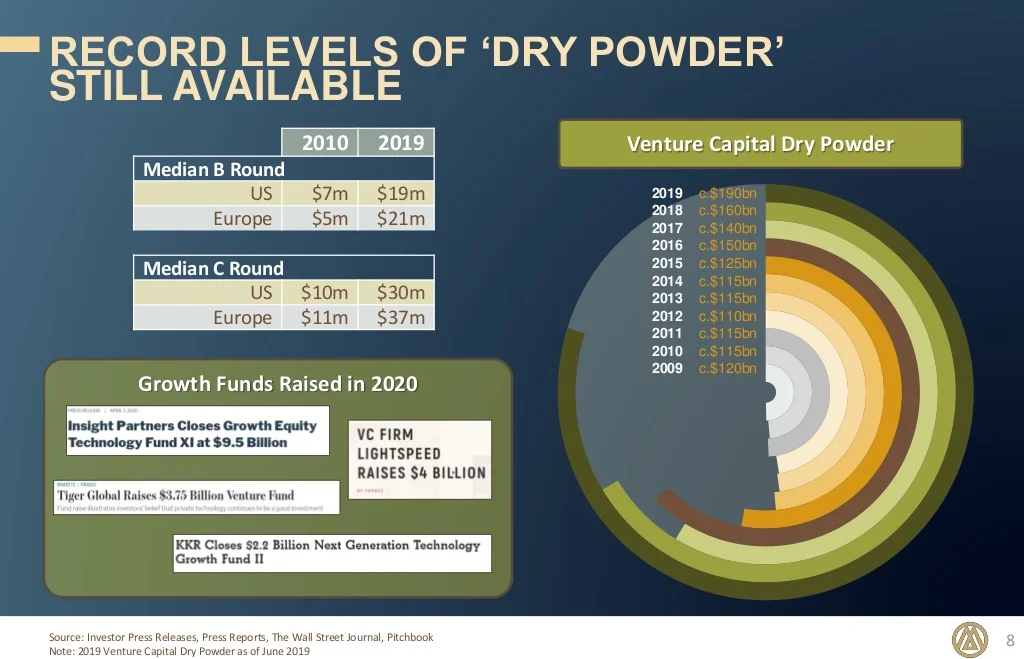

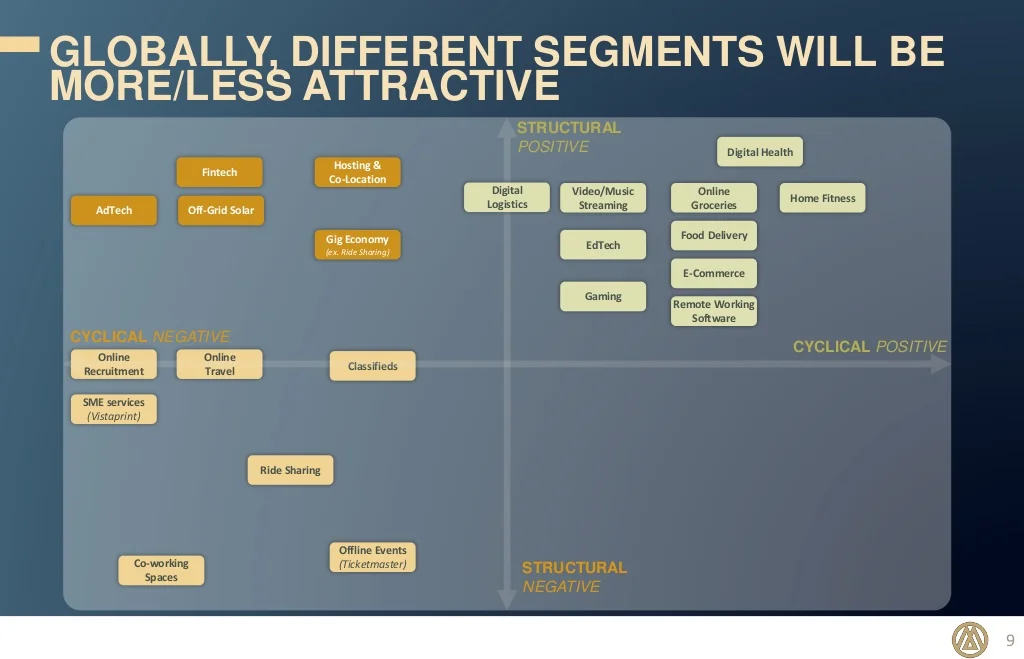

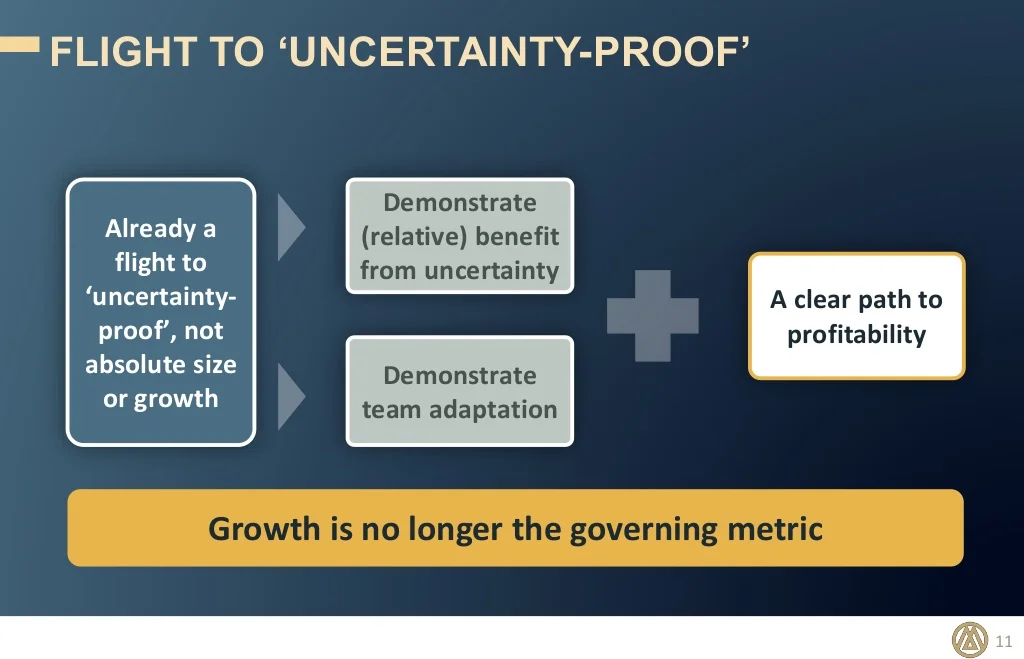

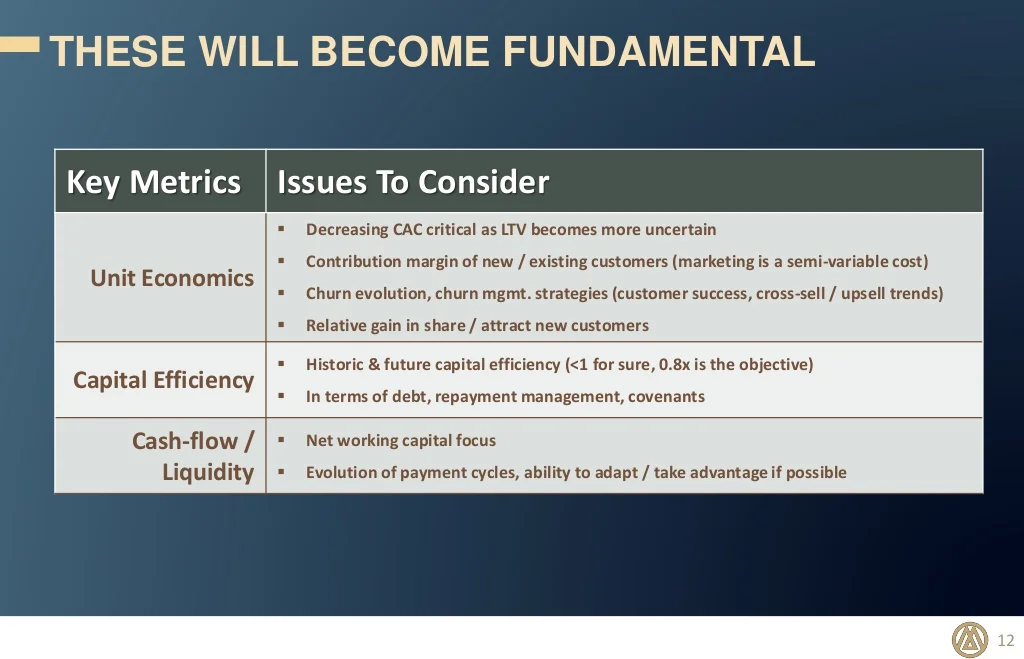

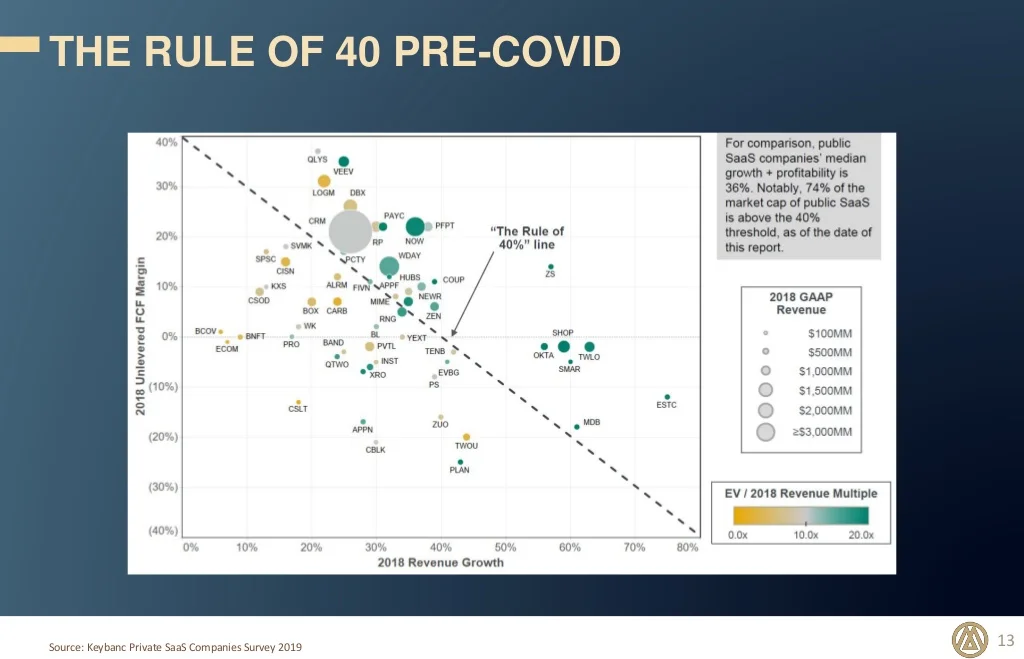

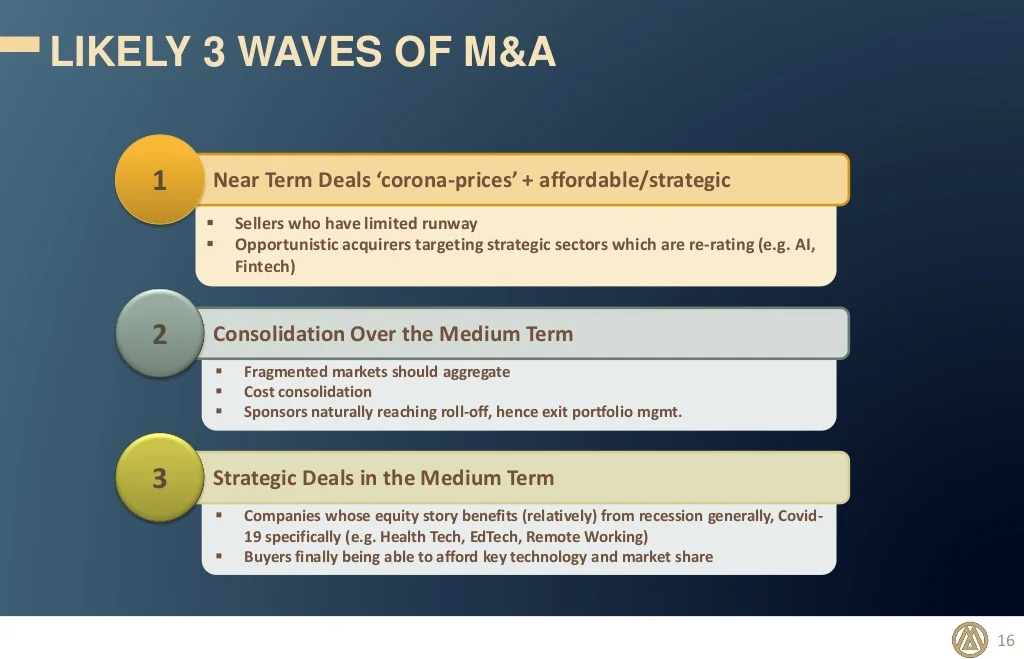

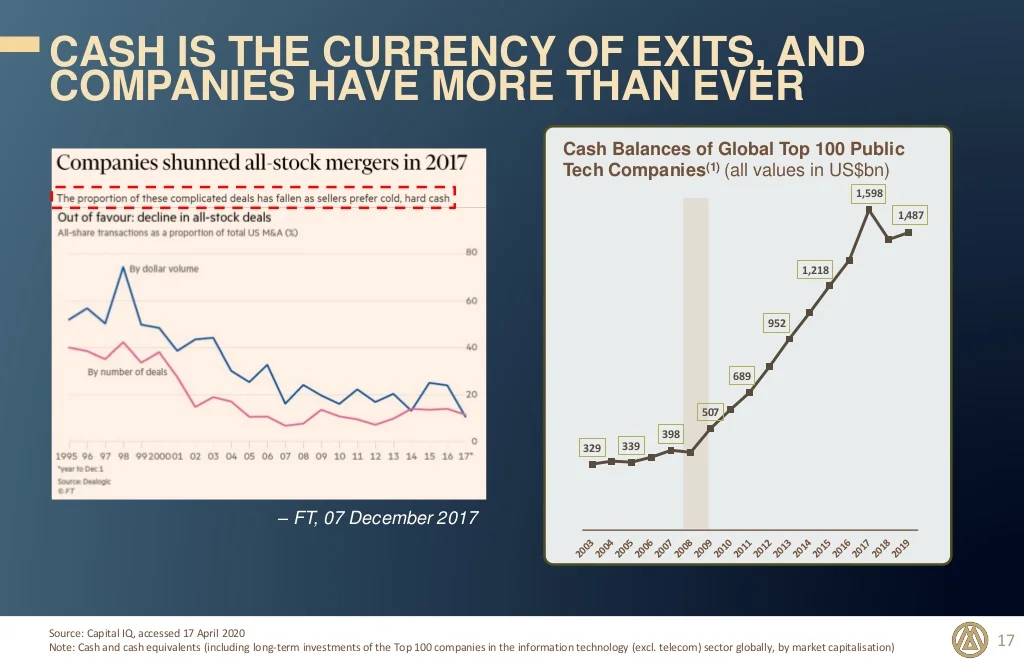

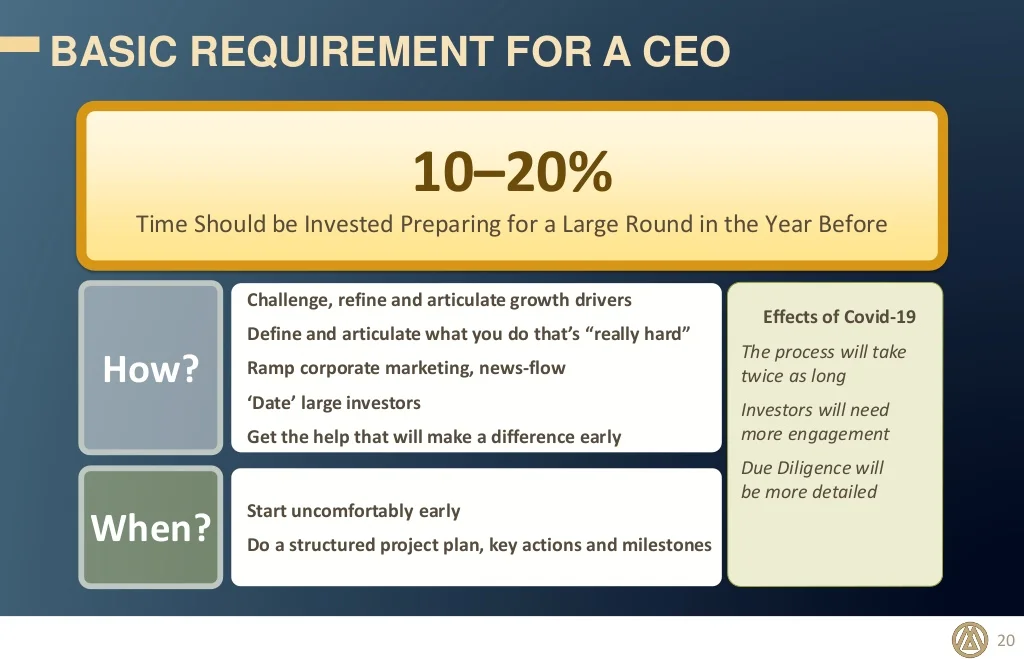

Many of today’s successful growth company CEOs have never had to raise larger (eg $30m+) rounds in a recession. Despite the deep pool of money available today, it is harder, and takes more preparation, to get a deal done. I recently led a CEO workshop on succeeding in large fundraising or M&A in COVID recession, sharing the slide deck here.

The actual workshop involved a lot of detailed discussion, happy to answer questions via LI or directly. Please like and/or share if you find it interesting.