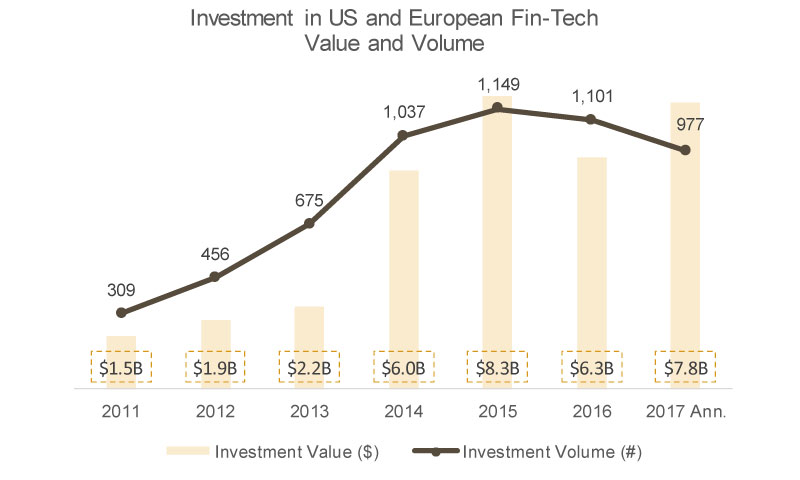

Perhaps the single biggest tech investment area the last 5 years has been fintech. In Europe and the US, disruptors of everything from lending to foreign exchange have raised unprecedented capital to challenge banks and their kin:

Conventional wisdom is this is a global phenomenon, and fintech companies are building significant enduring value.

I am not so sure, at least for European fintech companies. Here’s why:

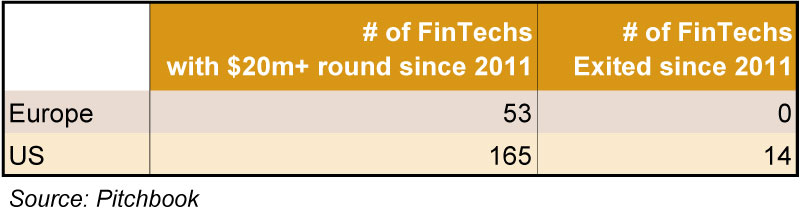

The global stats paper over stark differences between the US and Europe. There are 3x the number of US fintech companies that have raised $20m+ rounds versus European players. The reason this is so important is that companies raising these size rounds are already aspiring to valuations of several hundred $ millions, if not ‘unicorn’ status.

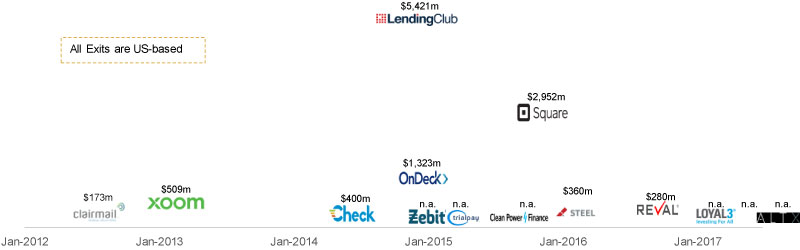

The differences become even more stark when we look at fintech exits so far (both M&A and IPO’s). Among this group of US fin-tech’s there have already been 14 exits, about 10% of all companies funded in larger rounds. For a sector that has started only a few years ago, that is a very promising early sign of real value being created, and it’s in line with other emerging sectors we have seen over the last 20 years. The fin-tech sector is ‘working’ for investors in the US.

In Europe, using the exact same parameters, there has not been a single fin-tech exit, despite around 50 fintech’s being funded in larger rounds. The only ‘exits’ we tracked: Lendico’s distress sale to Arrowgrass and POWA’s spectacular flame-out and rescue.

WHY NO FINTECH EXITS IN EUROPE?

Where have the European fintech exits gone? I think there are a few key points:

- Many fintech companies are valued too highly in financing rounds, and need years of performance for their ‘cash value’ to catch up to the financing round valuations. Whether its TransferWise, Zopa, Revolut or a myriad of others, financing valuations have raced ahead of these companies’ value based on revenue and profits.

- There is no European IPO market – Unlike the US where a large proportion of of the exits were IPO’s in Europe there is barely an IPO market for tech, let alone fintech. Investors in Europe have far less tolerance for a heavily loss-making ‘story stocks’

- European banks are a big buyer group of European fintech’s but cannot afford to buy heavily loss making fintech’s – many fin-tech’s regularly lose €5-10m+ a year, and no bank can afford to pay €100m+ and take on such losses

- Many fintech’s are single product, with too much market risk until they diversify – there is a race to broaden product offerings to generate more € from each hard-won customer, and until fintechs demonstrate they can scale multi-product businesses they cannot attract premium ‘platform’ company valuations, but remain at lower ‘product company’ prices.

- It takes decades not years to build a valuable fintech company – in our view many fin-tech’s require 10+ years to integrate into the existing financial system, broaden offerings, and build an enduring customer base. Working with money requires more trust, and more regulation, than selling little black dresses. Its just a fact, that some VC’s have chosen to ignore.

OUR PREDICTION

We believe fintech M&A will gain speed the next 5 years. Many fintech companies will fail to raise still-larger rounds, and inevitably consolidation will begin to happen. The issue is that much of this exit activity will happen at prices far below what investors are putting on well-known fin-techs today.

This will be a great next stage for the European fintech industry, but far less attractive for investors who have ‘paid up’ so far to get into the best early stage fintech firms. Those investors often have paid a big price unrelated to revenue and profits, and are facing many more years to get to a less attractive exit than they expected.