Negative news recently from Soundcloud, which cut nearly half its staff only a year after ‘mulling over’ a $1B M&A offer, is now the exception rather than the rule in European tech.

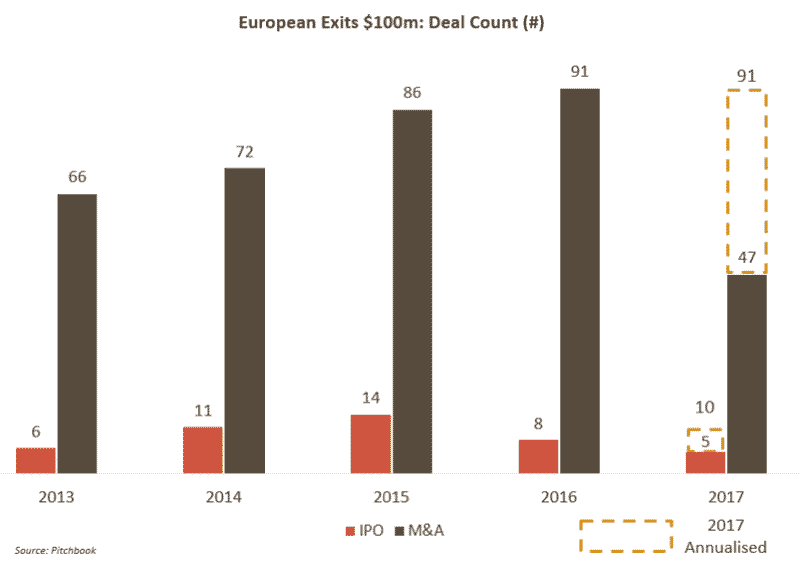

Magister’s analysis of $100m+ European tech exits shows there are now 100 exits valued above $100m each year, up sharply from 2013-14 when this hovered at 70-80. This jump is not a one-year wonder; $100m+ exits are tracking 100 again this year.

M&A deals not IPO’s drive activity. As the chart below shows, there 10x the number of M&A deals above $100m than IPO’s. Europe remains a market where exits are driven by strategic value to international buyers, not attractiveness to financial investors.

We believe this higher sustained level of larger tech M&A deals is due to several factors:

- European tech has matured hugely in the past decade. For every Soundcloud suffering from global competition, there are now a much larger crop of DeliveryHero’s, Spotify’s and Just Eat’s, companies setting the global standard in their industry and out-competing international players from Europe.

- European tech has that elusive combination of world-class IP and stable, world class talent – Musical chairs amongst the best Silicon Valley tech talent is stronger than ever, and only a few companies can withstand the high attrition. Many European centres offer much more stable teams, with some of the best IP available. Whether it’s DisplayLink in VR chipsets, Graphcore or DeepMind in AI, or N26 in digital banking (to name a few world-class examples), European companies now lead key market segments. Strategic buyers are willing to pay a premium for secure market-leading talent and IP they can leverage world-wide.

- European companies have improved hugely in marketing themselves – Ten years ago most European companies paid little attention to corporate marketing. Today, the likes of Tradeshift (B2B procurement) and Nutmeg (digital wealth management) sustain world-class marketing programs that really highlight the strategic value of their businesses.

- The quality of European companies has simply gotten better – CEO’s have become more experienced, investors have lived through more exits, the talent pool has deepened in historically problematic areas such as product marketing and international sales, and tech companies are generally far stronger and more balanced than ever before. As the underlying ‘asset quality’ as improved, so have prices paid.

- European founders are demanding higher prices – This one is simple. Ambition has grown. Investor backbone has stiffened. More capital is becoming available to fund longer independent growth. Benchmarking vs US players is easy and common. As a result, CEO’s are demanding international prices for their companies, a sea change from a few years ago.

- International buyers are looking all over Europe – Ten years ago a large tech buyer in Toronto or Shanghai was very unlikely to court a tech start-up in, say, northern Finland. Now this is so common no one is surprised. The depth of available information and the ‘death of distance’ has created a near-frictionless market for international tech M&A.

There are 700+ European tech companies that can achieve $100m+ M&A valuations over the coming five years. Many are working in key areas of interest such as fin-tech, SaaS, AI application in broad markets, and Internet of Things, which will only get more strategic in future.

This crop can produce years of “100 100” exits, 100+ deals each valued over $100m+.

There is no better way to accelerate the development of the European tech eco-system.