Amid the hype around Europe’s surging tech market, with talk of Silicon Valley losing its lustre to new hubs like London or Berlin, comes a sobering long term trend that suggests the complete opposite is in fact the case.

We analysed $25m+ tech financing rounds and $100m M&A exits in the US and Europe since 2005. The objective is in each case to capture companies worth $100m+ (most $25m+ funding rounds likely go into companies valued at $100m+). It’s not perfect, but a reasonable guess.

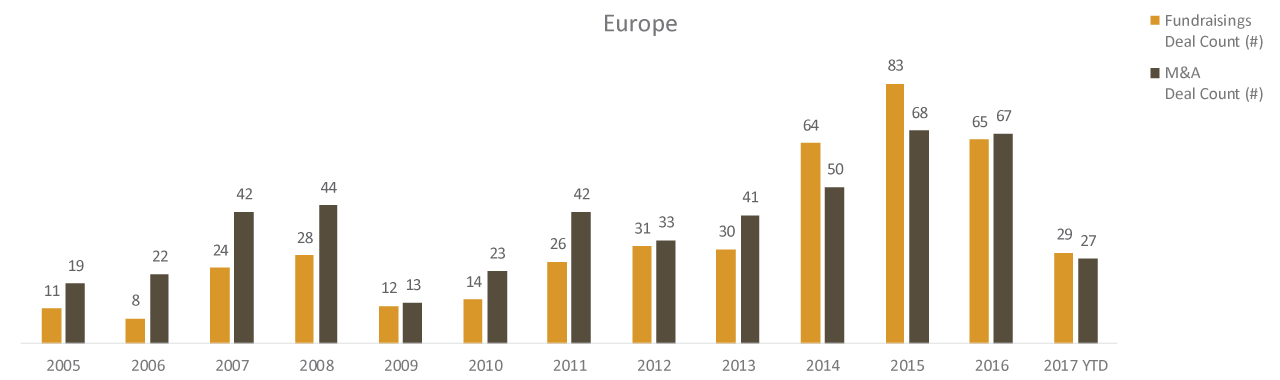

The results are striking and surprising. Since 2012, in Europe there have been nearly the same number of $25m+ tech financings as $100m exits, meaning for each company receiving major ‘scale-up’ capital another company of similar value was sold. Effectively this means that Europe is operating a ‘replacement market’ where the total stock of $100m+ value companies is flat over this very long period, a period when European tech ‘hype’ has reached unprecedented levels:

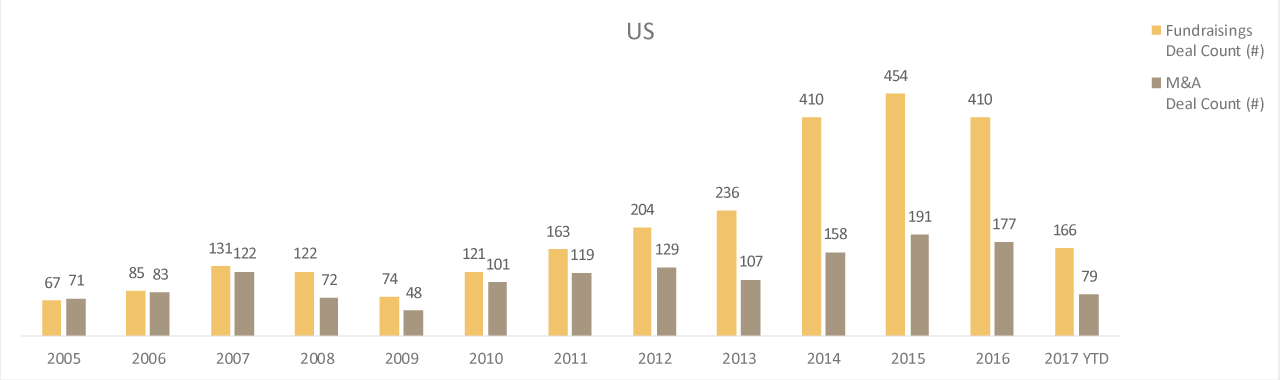

It could not be more different in the US. During the same period the ratio of $25m+ fundings to M&A was more than 2:1. Meaning there were two $25m+ financings for each $100m+ M&A deal done. As a result the stock of $100m+ value companies has skyrocketed by more than 500. Some have gone public, many have remained private, but it doesn’t change the result.

This is the opposite of recent hype. The US has created far more net $100m+ value companies in the last 7 years than Europe has, which isn’t hard since Europe’s net number is virtually zero. This despite the fact the US is a far more ‘mature’ market where you would far more likely expect to see such a ‘replacement-only trend.’

The US is creating nearly all the next generation of winners, European is creating nearly zero.

Our view is that this is a stark reflection of the lack of Series C and later capital available in Europe, which forces too many companies valued at $100m+ to sell rather than raise larger rounds. It also reflects the greater conservatism we still see among European investors.

Until the Series C financing black hole is addressed in Europe, European tech will continue to be a replacement market, while the US drives all net new company creation.

No amount of hype can overcome the Series C black hole in Europe, whose effects are far more pronounced than people generally want to believe.