We are in a perverse moment in the global venture capital industry: VCs are fast coming to resemble private hedge funds, and the more money they are able to raise, the worse-off startups are becoming.

Capital is flowing into funds of all types, yet the rate of investment is shrinking rapidly. This could mark the decline of ‘true venture capital’ by many funds, as they are forced to evolve into private hedge funds or momentum investors, investing far larger amounts in much later stage pre-IPO companies, and drifting further away from taking higher risk, long-term investment in innovation. Perversely, this risk is greatest for the most valuable, value-adding investors with the best track records, since they can raise the most money.

ACTIVITY IS DOWN

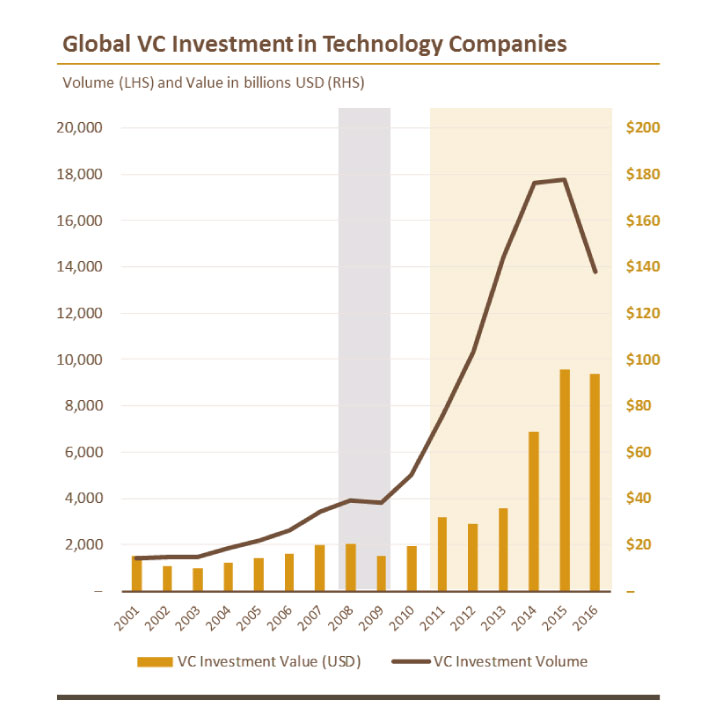

PwC and CB Insights have just reported that US venture capital activity was essentially flat in Q1 after a sharp drop over the past 2 years. While value is up 15%, that’s mainly due to larger rounds for more established companies, not ‘true venture capital.’ This does nothing to change the macro picture though, which is trending down:

RECORD AMOUNTS OF CAPITAL FLOWING TO VC FUNDS

At the same time, the last five quarters have been nearly the best ever for raising venture funds. Almost $50B in new venture funds has been raised since the start of 2016 ($40B in 2016, another $9B in Q1-17), and the tide shows no sign of abating. This is by far the strongest fundraising period since the heady days of the 2000 tech bubble.

It raises the obvious question, where will VC’s invest their hard-won war-chests, especially since the overall trend in number of deals is down?

VC’S PUSHED TO BECOME PRIVATE HEDGE FUNDS

My view is that the VC industry is evolving into a private hedge fund industry, raising larger funds and investing larger amounts in late stage companies which are well past the innovation stage. While very few of the best funds have the discipline to keep their fund sizes artificially down (at different times, both Sequoia and Kleiner Perkins Caufield & Byers took less money than investors offered), the vast majority of funds raise as much as they can.

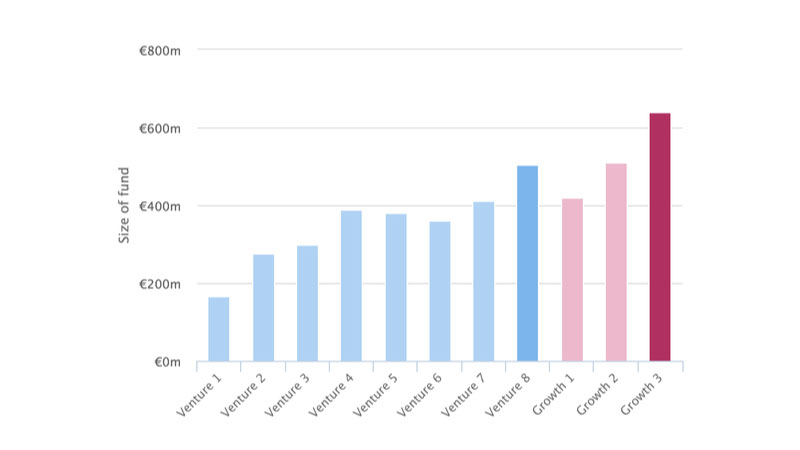

One example of this trend is Index Ventures, the US and European reference VC which has been a key investor in several high-value companies, from Dropbox to Skype to Just Eat. Below is the trend line of their fund sizes:

THE NEW FUNDS ARE RECORD HIGHS FOR INDEX VENTURES

Realistically, a ‘venture’ fund nearing $600m in size is already beyond the limit of being able to make real venture stage investments. Why?

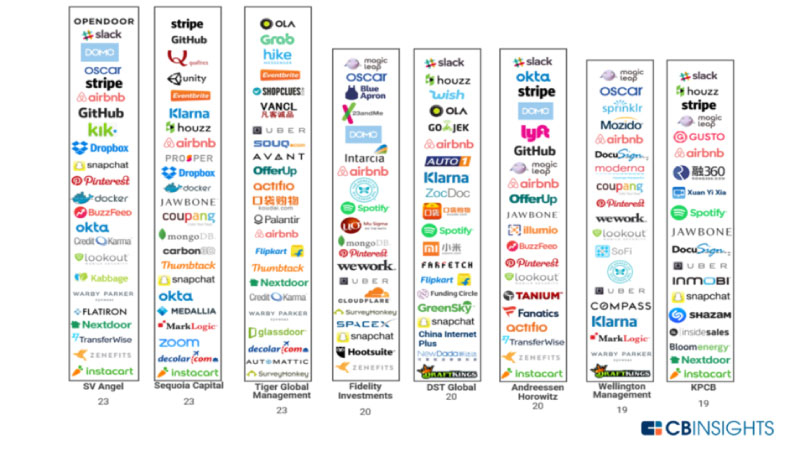

- Very few funds (Sequoia, Andreessen Horowitz, Kleiner and a few others) get to invest early in the highest value companies. Among CNBC’s 2015 Disruptor 50 list, Kleiner alone was an investor in 15. On CB Insight’s list of unicorns, only 3 venture firms feature in the most active group (the rest are late stage investors)

UNICORN HUNTERS: INVESTORS RANKED BY # OF PORTFOLIO COMPANIES IN THE GLOBAL UNICORN CLUB

AS OF 2/1/2017

Realistically, a ‘venture’ fund nearing $600m in size is already beyond the limit of being able to make real venture stage investments. Why?

- Very few funds (Sequoia, Andreessen Horowitz, Kleiner and a few others) get to invest early in the highest value companies. Among CNBC’s 2015 Disruptor 50 list, Kleiner alone was an investor in 15. On CB Insight’s list of unicorns, only 3 venture firms feature in the most active group (the rest are late stage investors)

UNICORN HUNTERS: INVESTORS RANKED BY # OF PORTFOLIO COMPANIES IN THE GLOBAL UNICORN CLUB

AS OF 2/1/2017

Any venture firm NOT in the top group doesn’t have the opportunity to invest early enough in high-value companies, to deploy a large $500-700m venture fund successfully.

- Companies generally need less money to scale now compared to a decade ago: AWS, cloud software, app stores, and development in low-cost markets have cut the cost of scaling a business by 50% or more vs. 10 years ago. For example, Facebook only had 3,200 staff when it IPO’d for $100 billion. Less capital needed equals less venture money required.

- Finally, there is now a ready market for large late stage rounds. Many companies are staying private much longer, and raising ‘mega-rounds’ before IPO’ing (witness AirBnB’s $1B round in Q1 2017). An unfortunate side effect of these ‘mega-rounds’ is that, as funds become driven by larger momentum investments, less interest and attention is paid to ‘ordinary’ venture investments going to the potential unicorns of the future.

This won’t overnight end funding for start-ups. If only a quarter or 1/3 of a fund is effectively a private hedge fund, there will be room to accommodate a large number of more capital-efficient start-ups. But if the majority of a fund goes to late stage ‘momentum rounds’ which perform reasonably well, VC’s will care a lot less about venture in future.

The more money VC’s are able to raise, the worse it is for start-ups.

Find out more about DAI Magister