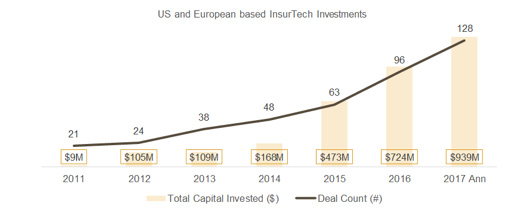

Fin-tech backers have turned their attention to disrupting the whale-sized insurance industry. Just like payments, trading, and banking before, investors see insurance as an inefficient, huge, slow-moving business where innovation is long overdue. And with the largest player, China’s Ping An, breaching $100B in revenue, its surely a big enough pond for hundreds of start-ups to scale. No wonder insurtech financing is up sharply everywhere:

Our view is this is too superficial. Disruption has partly happened already with price comparison sites. And while consumers engage with banks and payment vendors daily, they only engage with insurers only when necessary. And most often they buy based on price.

FIRST-WAVE DISRUPTION ALREADY HAPPENED

There are more than 50 price comparison sites (PCW’s) for insurance world-wide, including the UK’s confused.com, India’s PolicyBazaar, and compare.com in the US. PCW’s started in 2002 in the UK, and have disrupted insurance distribution fundamentally; over 50% of Americans now use an aggregation site to make insurance decisions, and over 50% of UK car policies are written via PCW’s. PCW led disruption is old news.

SECOND-WAVE DISRUPTION REQUIRES FULL DIGITAL INSURERS

There is however a whole second wave of potential disruption still to come, though it requires creation of full digital insurers. Many insure-tech start-ups instead aim to rely on existing firms to provide products and ensure regulatory compliance. As such they are simply ‘front-ends’ for the industry. We see this as no different than PCW’s before, whether you use an app or a site to help make buying decisions, it doesn’t disrupt much.

I believe the only way to disrupt the insurance industry is for a new generation of digital insurers who write their own policies, manage their own risk, and handle regulation directly. These ‘full stack’ digital insurers can then take a completely fresh approach to insurance products, without having to rely on existing, ‘legacy’ products from incumbents.

Two examples of this new approach are Guevara in the UK and Lemonade in the US. Guevara’s ‘peer-to peer’ model pools premiums for drivers, and refunds excess premiums not paid as claims; 90% of their customers save on their car insurance. And Lemonade in the US specifically targets millennials with a transparent all-in-one service, paying out excess profits to charities. In both these cases, full digital insurers are lowering the cost of policies and providing a completely new service to the market; to me that’s the definition of disruption.

Contrast this with, for example, Knip in Switzerland, which essentially aggregates existing policies onto a mobile app. While there’s nothing wrong with apps like Knip, in my view they aren’t disruptors, rather a better version of existing aggregation services. It’s much harder to see these app-centric companies achieving big long term value.

IT WILL TAKE 10+ YEARS TO REALLY DISRUPT AT SCALE

To build a digital insurer of scale in my view will require the best part of 20 years, even with the best team and sharpest strategic vision. A recent comment about traditional insurer Hiscox’ US expansion puts this into focus:

if you look at a firm like Hiscox, which is a carrier in the UK but also sells small business insurance here in the US, for them to accrue $100m premiums, it took seven or eight years and that’s a carrier, a large company with all the resources to bear…”

In my view if Hiscox took nearly a decade to achieve US market penetration, 20 years for an upstart digital competitor is barely enough time. And when you consider insurers at scale generate $ billions of premiums, not $100m, even at internet speed building a digital competitor to Allstate and AXA could take 30 years.

The main issue with this is investor timeframe. VC’s must work on a 5-10 year ‘clock’ to generate returns, which is incompatible with the time required to create a $1B+ insure-tech business.

FUTURE WINNERS ARE THE ‘BIG PLAYS’ NOW BEING SCALED

Overall, we believe there is huge value in a subset of insurtech start-ups, those building a full digital insurer, and creating new products and services to the market. Customers usually care only about price, and drastically reducing insurance costs requires such radical rethinks.

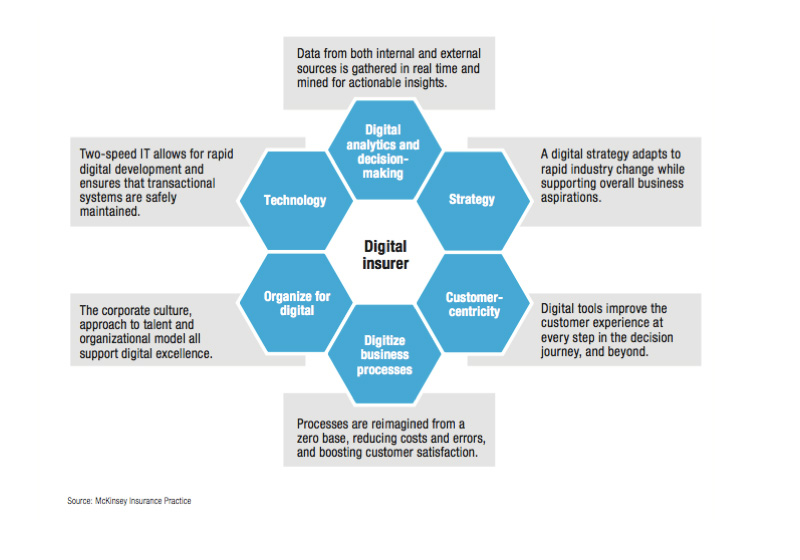

The roadmap for this is already clear. McKinsey’s view of a digital insurer encompasses a complete digital rethink of every aspect of the insurance process:

Insuretech isn’t disruptive, but insuretech companies now preparing to make ‘big plays’ as digital insurers most definitely are.