Rocket Fuel’s recent rock-bottom $125m sale to Sizmek confirms an unavoidable trend in advertising technology (adtech). What has transformed advertising has generated almost no value for investors, while Facebook and Google, have scooped all the value for themselves.

It is only a few years since investors were racing to invest in adtech, Rocket Fuel traded at $2B, and Millenial Media rocketed to $2B after IPO. Now Rocket Fuel has lost 95% of its value, while Millenial sold for 90% less to AOL in 2015. The trend is widespread; content analytics firm Visible Measures sold for $10m after raising $70m. Business Insider’s take on Rocket Fuel’s sale is to the point:

The deal appears to mark the end of an era for the ad tech industry, which has been characterized by a massive flood of funding, a proliferation of start-ups, several rocky IPOs, along with lots of layoffs, pivots and consolidations over the past half dozen years.

AD-TECH’S IMPACT CANNOT BE UNDERESTIMATED

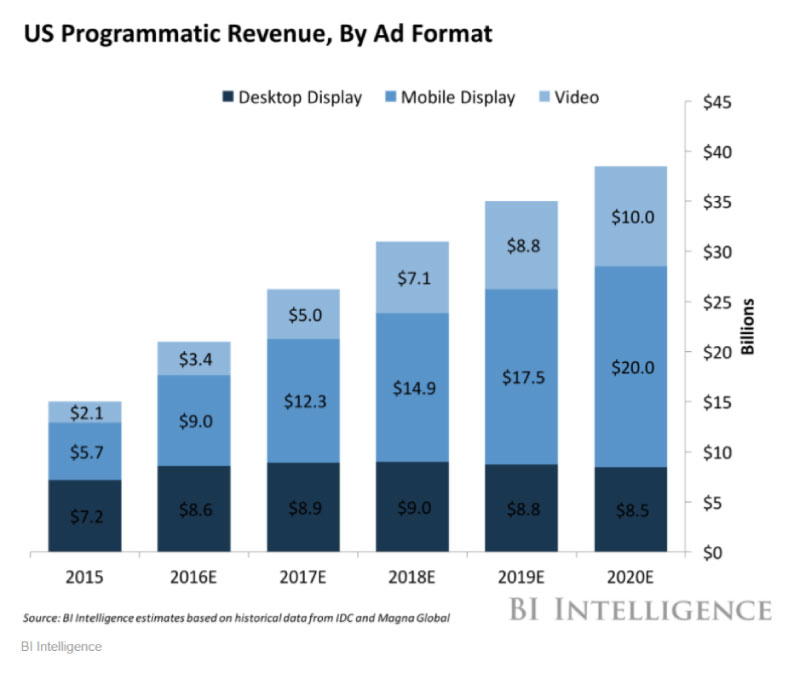

Ten years ago, ad execs couldn’t spell ‘programmatic.’ In a few short years, programmatic advertising passed $20B and is on course for $40B in revenue by 2020, along the way disrupting a centuries old industry:

In fact, internet advertising (effectively all programmatic) will surpass TV in 2017, as the single biggest ad-spend category:

ADTECH INVESTORS HAVE HAD A WILD RIDE, ENDING IN A CAR CRASH

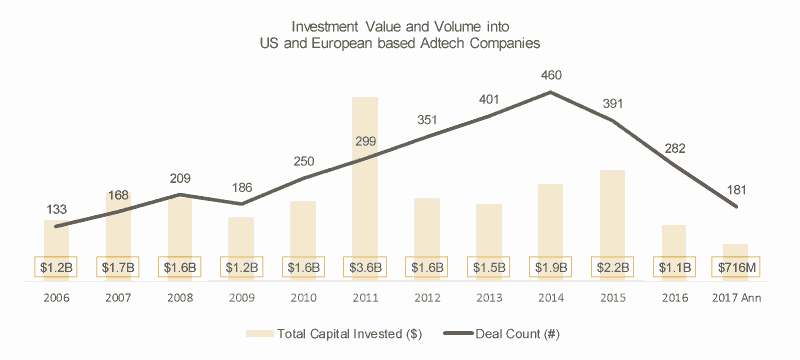

Until 2014, adtech investment was on a hill-climb, reaching nearly 500 investments annually. In one year (2011) close to $4B of capital was pumped into adtech, fuelling creation of over 1,000 ad-tech companies.

Since then, investment has plummeted even as the sector has continued disrupting advertising. Today no VC will touch ad-tech no matter how ‘disruptive’:

WHAT WENT WRONG?

How did such a force destroy so much value for so many savvy investors? And what can we learn for future disruptive waves?

- There were just too many adtech companies – Not only were 1,000 companies created, there were 2,500 different adtech tools to overwhelm corporate marketers. Many tools overlapped in functionality; features innovated by one were copied quickly. Moreover, many ad-tech companies built tools which were tech-rich but hard to use by corporate clients. Adtech led with tech, not ad, and you can’t build enduring client relationships with complexity.

- Conversely, in other segments there was often less tech than promised – A good example is video advertising. Many video adtech companies were little more than dressed-up ad agencies using some tech to create and distribute videos. Most claimed to be adtech during boom fundraising times, without doing the hard work to create a full tech capability.

- “Walled gardens’ of data prevented many tools from working effectively – Rich data trumps good algorithms; nowhere is this truer than ad-tech. A small number of giants, notably Google and Facebook, claimed huge proprietary walled gardens of data that gave them a priceless competitive advantage against third party tools. Coupled with $ billions invested in their ad-tech efforts, they tilted the playing field so much that 75%+ of mobile ad spend now goes to these two.

- Mobile made ‘traditional’ ad tech (cookies, retargeting) much harder – Cookies and retargeting were the life blood of first-wave ad tech, until advertising moved abruptly to mobile. Overnight it became much harder to place targeted ads; just identifying when a customer moved from desktop to mobile was a Herculean task. More recently the rise of sophisticated mobile ad blockers (Apple has led the way, having nothing to lose since it doesn’t sell ads) has compounded the challenge of making mobile ad revenue.

- Adtech created lots of value, it just all went to Google and Facebook – Google and Facebook have one line of meaningful revenue, advertising. Google’s $100B annually is growing $20B/year. $20B of new adtech revenue annually validates all the VC investment made in the sector; the shame is none of it goes to companies VC’s backed. In short VC’s were right about the sector, but utterly wrong about who would win.

WHAT NEXT?

Today, there are 1,000+ adtech companies across Europe and the US. Many are working with interesting customers providing specialist services to help corporates take full advantage of digital.

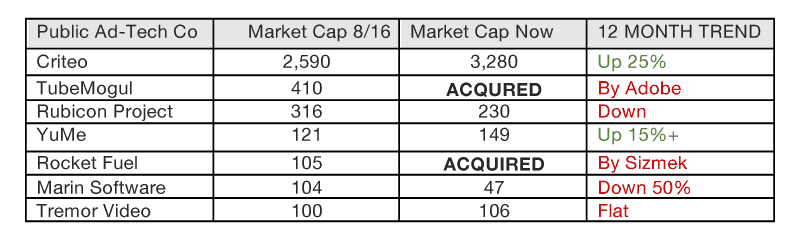

However, we believe most have no independent future. We expect there will be a wave of adtech mergers and acquisitions. Vendors need to become larger and broader to continue being relevant to corporate customers. Below a table of the largest public ad-tech companies’ valuations now and 12 months ago. Two of the seven have already been acquired. Besides Criteo, the rest are public market ‘minnows’, nearly all of whom should be sold in the next 2-3 years.

More broadly, we expect the universe of adtech companies to reduce by nearly half in the next five years. They cannot combine fast enough; survival depends on it at this point.

While adtech continues to disrupt advertising, there are no longer any disruptive adtech companies.