Currency devaluations and inflation erode investment returns, reducing a company’s valuation and the value of its total addressable market (TAM). However, several sectors have demonstrated resilience in such conditions and can actually to generate substantial shareholder value in difficult economic times. A major example is Egypt which suffers from an inherent current account deficit and imports most basic commodities, including food. In markets like this currency devaluations result in nearly a 1:1 inflation pass-through to customers.

Non-bank lending and payments offer the best investment opportunities in Egypt’s current macro environment. We estimate that there will be at least $500m in transaction value amongst companies in the non-bank lending and payments sectors in 2023 which investors can potentially capitalise on. Moreover, there is financial and strategic investment appetite in those two sectors, as demonstrated by various successful exits, enabling investors to eventually realise significant profits.

The impact of currency devaluation

The impact of a currency devaluation on a sector and company level can be broken down into 3 buckets:

The losers

These are typically capex-intensive businesses, particularly those in the industrial sector where capex is denominated in foreign currency. Non-exporting manufacturers are also particularly hard hit as they rely on imported raw materials.

The neutrals

Companies and sectors that fall under ‘Neutral’ divide into two groups. The first is businesses in inflation pass-through sectors, such as retail and consumer staples. Such businesses can quickly adjust their prices in response to currency devaluation and the resulting imported inflation

Retail/consumer staples tend to fall into this category, which can be extended to various sectors that depend on retail activity such as groceries, B2B commerce, payments, etc. These tend to be companies and industries that generate revenue via a take rate mechanism linked to a ‘consumer staples-like’ GMV (i.e., grocery for Food Tech business/B2B commerce such as Breadfast and MaxAb or bill payments in the case of e-payment companies like Fawry).

The second group consists of businesses in sectors that may not be able to raise prices enough over the short to medium term to offset the impact of currency devaluation. As consumers seek ways to alleviate the squeeze on disposable income, gig economy companies benefit from demand-led growth, offsetting their inability to raise prices enough to combat devaluation. Examples of such sectors in the gig economy include ride-hailing, freelancer marketplaces, and home rentals.

The winners

The winners are typically lending companies and export-oriented industries such as manufacturing and tourism. Specifically, lending businesses benefit in three keyways:

- Larger ticket sizes due to inflationary pressures

- Higher volume of lending due to an inflationary-driven squeeze in consumers’ disposable income

- Higher net interest margins (NIMs)/lending spreads resulting from rising interest rates designed to curb domestic and imported inflation

Due to government intervention, investors have viewed Egypt’s manufacturing sector as largely un attractive because the private sector was competing with the state, which investors deemed a losing battle. Late last year, the International Monetary Fund (IMF) imposed restrictions to cut the state’s footprint and level the playing field, potentially opening up investment opportunities and unlocking the $3bn extended arrangement Egypt needs.[1]However, the net impact here remains yet to be seen.

The Egyptian kings

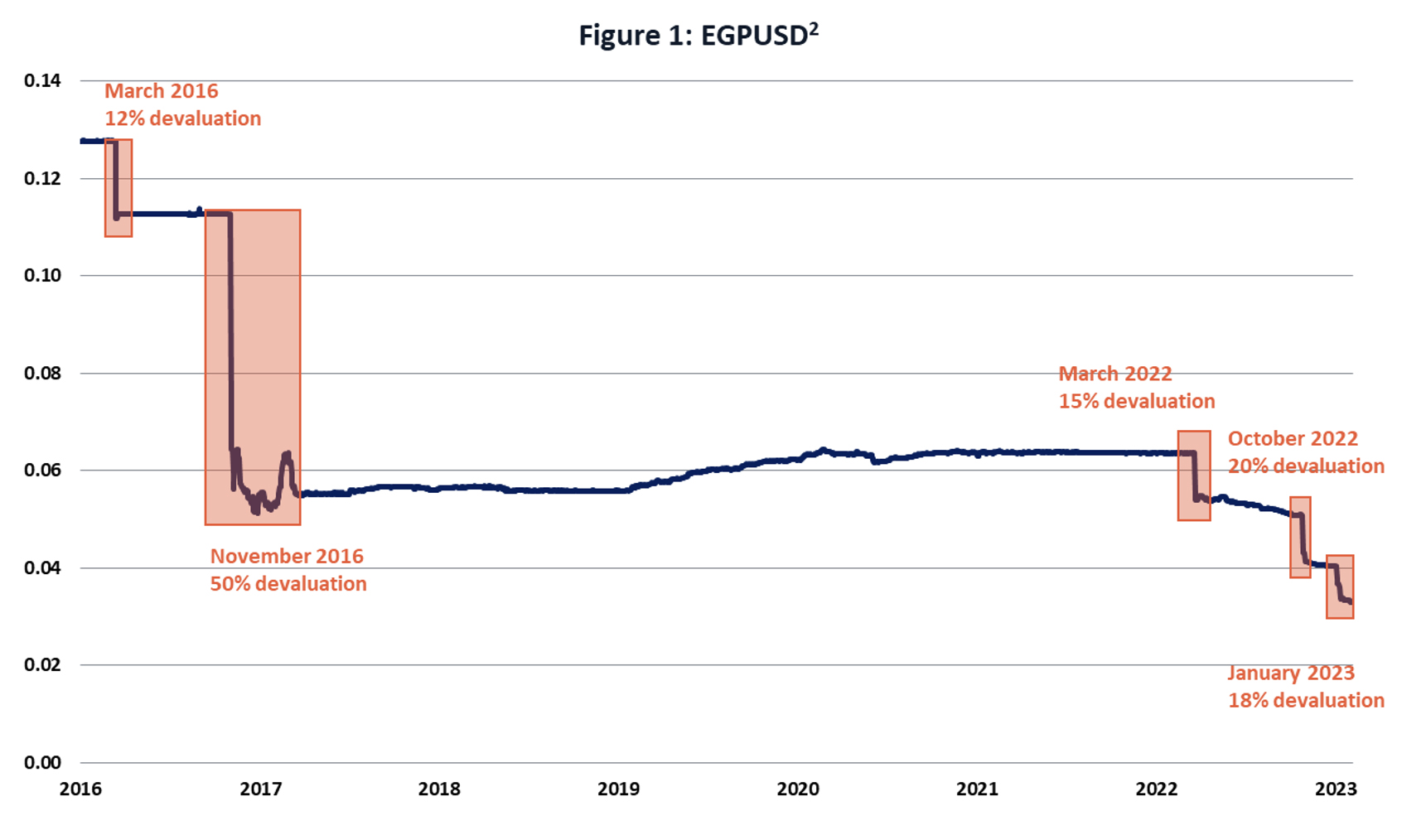

Egypt has experienced five significant currency devaluations since early 2016 (see figure 1 below), with the currency depreciating 35% since October 2022. Despite this challenging economic climate, two sectors have emerged as “winners”: Non-Bank Lending and e-Payments.

Source: CapitalIQ as of February 06, 2023

B.Tech is Egypt’s largest retailer of household appliances and electronics at the surface, but the company’s primary source of revenue and profits comes from consumer credit financing. With one of the country’s largest non-bank consumer lending portfolios, the company has established itself as a major player in the Egyptian market.

In February 2016, immediately before the first episode of currency devaluation, DPI acquired a 33% stake in B.Tech for $35m, valuing the company at $105m. [2] 6.5 years later, despite Egypt’s currency devaluing by 54%, DPI realised a 4X return on their investment by selling their stake to Saudi Arabia’s PIF for $150m in August 2022, valuing B.Tech at $450m.[3]

MNT Halan is a leader in Egypt’s fast-growing consumer finance and small & micro business lending verticals. In August 2018, DPI acquired a 25% stake in MNT from GB Auto for $45m[4], valuing the company at $180m.*

Fast forward to October 2022, Chimera bought a 7.5% stake from GB Auto for $60m, valuing MNT at $800m.[5] In February 2023, Chimera invested $200m in equity in return for 20% of the company, taking MNT’s post-money valuation to $1bn.[6] Using either data point, DPI has so far managed to achieve 4.5 X (unrealised) return on its investment, despite the currency depreciating by 40%.

Reefy specialises in small & micro business lending. In 2017, the company obtained the first licence in Egypt to finance micro enterprises and served 300,000 customers at the time.[7]

CI Capital acquired Reefy in December 2017 at a valuation of $23m (400m EGP).[8] Despite the currency depreciating by 40% since then, Reefy has grown income by 28% a year in $ terms since then, and Reefy would be valued at least $200m in today’s market when using comparable multiples (P/E), implying a 10 X + return on their investment, if realised.

Fawry, Egypt’s leading e-payment company, enables banked and unbanked customers to pay a wide range of bills through multiple channels. As of 2021, the company had a network of 166k agents and 34 bank partnerships, serving close to 30 million customers and processing nearly 3 million daily transactions.[9]

In November 2015, Helios acquired an 85% stake in the company at a value of $100m. Fawry went public via an IPO in August 2019 with a market cap of $360 million[10], reaching around $2bn at one point before settling down to $666m as of February 2, 2023.

E-payments might be classified as ‘neutral’ when it comes to the impact of currency devaluations, but is also poised to continue growing, underpinned by structural growth drivers.

Tanmeyah provides lending services to microenterprises in Egypt. By the end of Q1 2022, the company’s total number of clients had grown to 391k with a portfolio size of $160m.[11]

In February 2016, EFG Hermes acquired a 76.7% stake in Tanmeyah for 345m EGP [12], valuing Tanmeyah at $58m before EFG Hermes fully acquired the company. Between 2016-2021, Tanmeyah’s income grew nearly 90% a year again in $. Today, it would be valued around $500m + based on comparable P/E multiples.

Non-bank lending & e-payments poised to deliver exponential returns

Egypt’s non-bank lending and e-payments sectors have proven resilient to FX depreciation and investors can expect them to continue delivering exponential returns in the years to come. The non-bank lending sector benefits from effective cash collection policies with NPL ratios for the companies mentioned earlier in the single digits range. Investors have achieved 4-10x (USD) returns despite the country experiencing a series of currency devaluations and political turbulence. The non-bank lending sector in particular benefits most from currency devaluations as imported inflation results in larger ticket sizes, lending volumes and interest rate margins.

Provided the proper governance structures and processes are in place (i.e., effective cash collection, low NPLs, profitability, etc.), the non-bank lending sector is one of the most attractive sectors to invest in across both early and late stage because companies can generate meaningful profits and positive cash flows early in their development. Both sectors also benefit from structural growth drivers, given 73% of Egypt’s 110 million population is underbanked

This may offer opportunities for companies in adjacent Fintech verticals as more mature players seek horizontal and vertical integration via inorganic growth/acquisitions. For example, Paymob and Khazna’s partnership[13] to expand access to digital financial services and Tanmeyah’s acquisition of Fatura (a B2B e-commerce marketplace) in mid-2022 in order to fill the credit gap in the B2B market[14] are examples of the appetite and opportunities for Fintechs to vertically and horizontally integrate.

Moreover, the acquirer types are diverse in nature including corporate (i.e. CI Capital & EFG’s acquisitions of Reefy and Tanmeyah respectively), quasi-sovereign (Chimera’s acquisition of GB Auto’s stake in MNT) and sovereign (PIF’s acquisition of DPI’s stake in B.Tech). This provides investors with a wide range of exit options to turn investment returns into cash much more quickly, and more certainly, than in many other sectors of the African growth landscape.

We have identified 20 non-bank lending and 3 mature e-payments businesses in Egypt, of which there are nearly 10 businesses are at growth stage. Based on last year’s fundraising activity, recent Fintech fundraises and secondary transactions in Egypt and exit time horizons for existing investors, we believe those businesses will be seeking transactions in the region of $50m-100m+ each in the form of primary and/or secondary capital. In conclusion, there will be at least $500m in transaction value in the non-bank lending and e-payments sectors which investors can potentially capitalise on in Egypt’s current macro-environment.

Learn more about us.

* Despite the article stating that DPI acquired a 33% stake, the 33% stake is effectively 25% as MNT Investments (holdco) owns 75% of Mashroey and Tasaheel (the lending business).