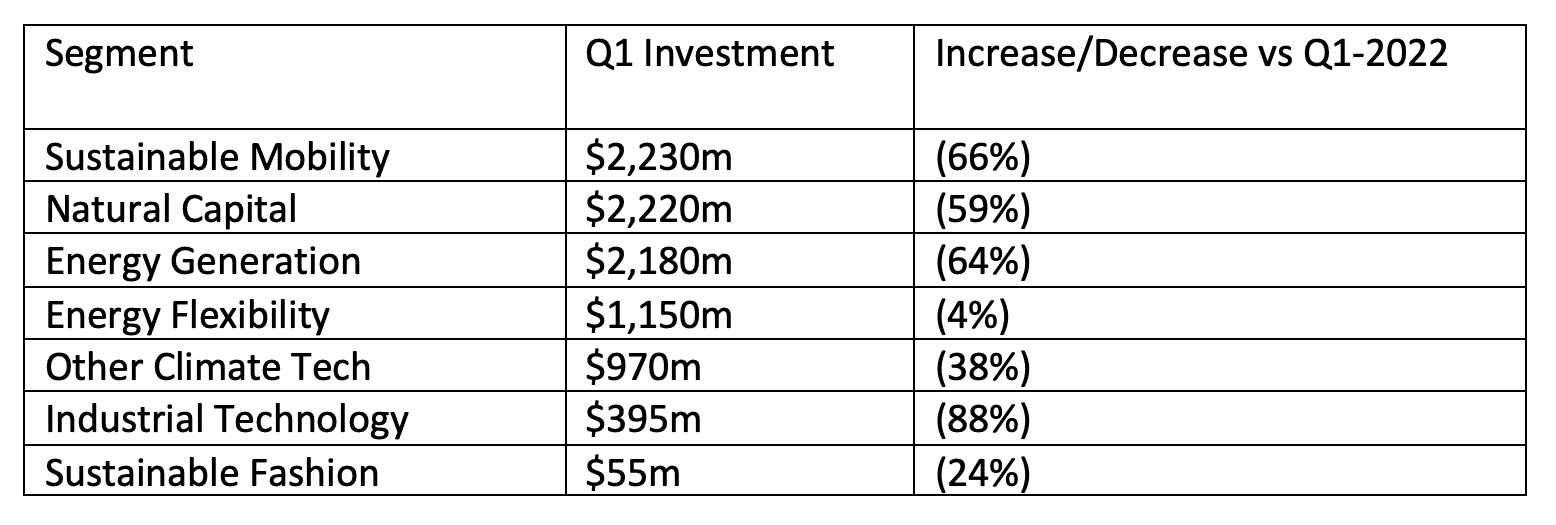

Even as January broke warm-weather records across Europe [1], climate tech investment fell 56% in Europe, about the same as the global decline. Virtually every segment of the sector attracted less capital, as investors pulled back from 2021-22’s record pace of investment (Global Breakdown):

Not only total investment, but also the number of funding rounds fell, from 384 in Europe in the same period last year to 132 during this year’s first quarter.

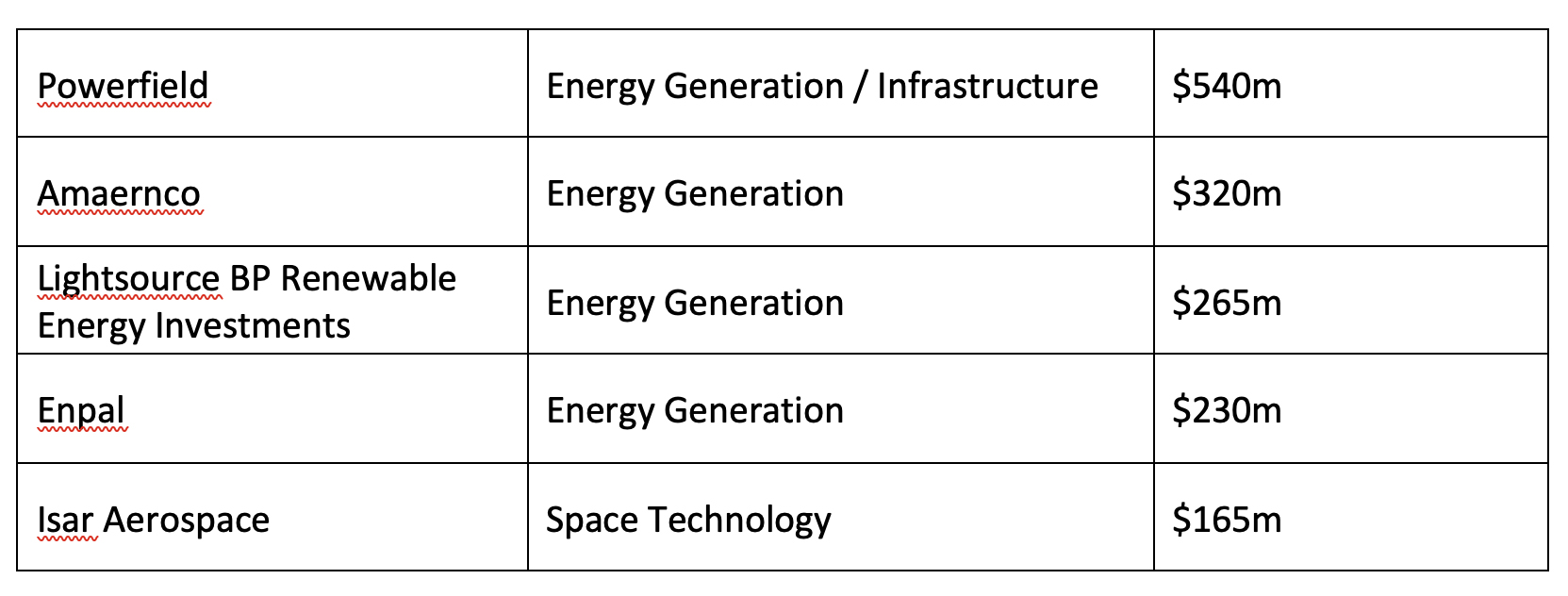

The five largest European climate tech financings closed mostly in energy generation, with Isar Aerospace’s recent round also making the list. The trend of the largest climate deals being in energy generation (especially solar) is common to both the US and EU so far in 2023, though in Q1 2022 there was greater variety, with large deals across agritech, construction technology, and sustainable mobility.

Down in a down market

Up to this last quarter, climate tech had remained remarkably resilient, with total capital last year nearly the same as 2021’s high water mark. A new crop of climate investment funds raised fresh ‘dry powder’ during the last two years and began actively backing growth companies across the climate tech sector. These were joined by a whole crop of generalist funds targeting climate-focused companies looking to expand in a range of segments across the US and Europe.

With the downturn in valuations and investment activity, it appears that investors have pulled back generally, including from promising climate tech companies. “Rounds are still getting done but are certainly harder to navigate than 12-18 months ago, and generally require more time and effort to close, even for the most promising growth companies in Europe and the US” noted our climate-team Chairman, Marc Deschamps.

Interestingly, larger rounds in European climate tech are proving more resilient than earlier stage rounds; $40m+ financings are down only 23%, half the decline generally in Europe. The reason for this preference for larger rounds with more established companies is the lower risk appetite amongst climate investors in Europe.. In short, it remains easier to raise a larger round today in Europe than a smaller one.

Mandate Effects Not Fully Felt Yet

Yet the most promising tailwinds for the climate tech sector remains only partly felt so far this year. Government initiatives already in place are set to bring down climate tech companies’ effective cost of capital and create significant new sources of revenue. Yet the US’s Inflation Reduction Act, the EU’s mandate requiring all new vehicles to be electric by 2035, and Germany’s specific push to implement hydrogen broadly across its economy, as just three examples, have only started to be felt in terms of revenue and opportunity for climate tech startups in the US and Europe. So thus far in 2023, for many VC’s it remains just a little too early to see the benefits of these initiatives clearly.

Meanwhile M&A Activity Picks Up in Two Key Segments

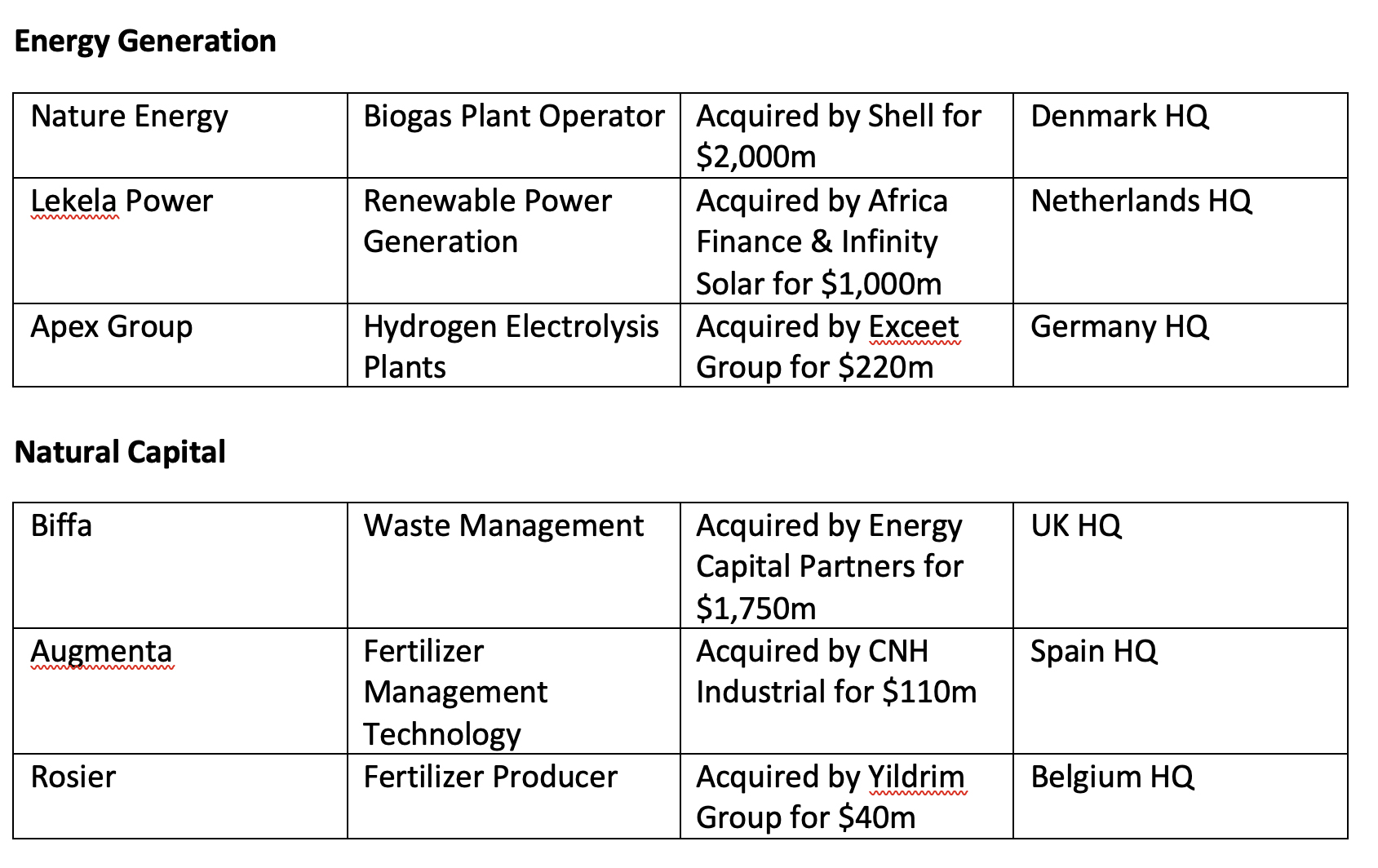

While financings remain challenging to close, M&A activity remains strong particularly in Europe’s energy generation and natural capital segments. DAI Magister’s analysis recorded 30 M&A deals in energy generation and 57 in natural capital just in the first quarter of 2023. In general, these M&A deals are being driven by strategic buyers, who account for 60% of deal activity across both segments, with private equity firms representing less than 20%, and the remainder being closed by private buyers.

The push by strategics to expand in these two segments signals a broad-based desire to acquire key assets for long term production of renewable energy, as financing has become more expensive for such projects in the wake of repeated interest rate hikes both sides of the Atlantic. In Q1, the most significant European M&A deals in generation and natural capital were:

With the cost of money rising everywhere, strategics can compete successfully to acquire key assets which they can then finance and develop to fruition, and we expect that trend to continue as long as the cost of capital generally remains at current levels.

“Many climate tech companies remain small, with most still raising their Series A or B rounds” said DAI Magister CEO Victor Basta. “The select few climate tech companies which have already achieved scale already stand out, not just in size but also strategic attractiveness. We expect more M&A activity to begin substituting for now more-challenging VC and growth capital, and it’s a different way for the industry to achieve its overall, critical objectives.”

Trend for 2023 Overall

As the sector swings into Q2, DAI Magister’s view is that financing activity remains challenging. There will likely be a record number of $100m+ rounds, simply because more climate tech companies have ‘graduated’ in size to qualify for that amount of capital. We have already seen this trend start to play out in EU climate deals above $40m, where the average deal size has risen from $107m to $160m as larger rounds become more common.

However, the downturn in smaller rounds look set to continue, with capital raised in rounds below $25m down 42% globally. Overall, a persistently challenging environment is likely to continue to trigger more M&A both among strategics looking to acquire key assets, as well as mergers between climate tech startups in the same segment who now need to demonstrate greater scale to qualify for a successful larger fundraise in the coming 18 months.

Learn more about us.