(Updated 1/10/18 1:30 pm. See below.) In China, 2017 was the year of the rooster. But in the United States, it was the year of the unicorn—at least according to the Venture Monitor report released today by Seattle-based PitchBook and the National Venture Capital Association.

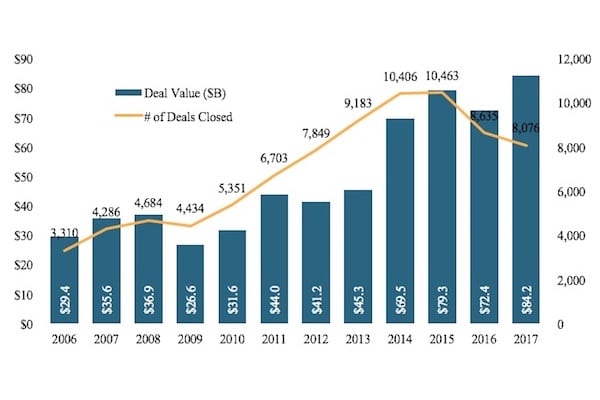

A record number of unicorn financings—venture-backed companies valued at $1 billion or more—helped drive U.S. venture funding to a total of $84.2 billion in 8,035 companies (through 8,076 deals) in 2017, according to Venture Monitor data. As the authors put it, that’s a level of VC funding unseen since the early 2000s—harkening to the dot-com era.

PitchBook, founded in 2007, can’t provide authoritative data for venture funding activity before 2005. Using reconstructed venture data, though, the financial data firm estimates that venture firms provided $23.6 billion to 2,952 U.S. companies in 2005. But PitchBook’s claim is in the ballpark. MoneyTree data from PricewaterhouseCoopers shows that venture funding peaked during the dot-com boom in 2000, when VCs invested more than $120 billion in 8,671 companies nationwide.

In 2017, Unicorns alone raised a record $19.2 billion from venture investors, accounting for nearly 23 percent of all venture capital invested last year. At the same time, though, the 73 unicorn deals PitchBook counted in 2017 represented less than 1 percent of the year’s overall deal volume.

So continues the trend of more VC dollars in fewer VC deals.

In a statement today, PitchBook founder and CEO John Gabbert notes that “the VC ecosystem appears healthy and driven by different dynamics” than it was during the dot-com boom. “Exciting later-stage companies with strong consumer traction are commanding large rounds of financing.”

Victor Basta, managing director of Magister Advisors, offered an alternative view in a recent contribution to TechCrunch that highlighted how the unicorn era of record late-stage deals has been accompanied by an implosion of early stage venture funding. Using the same PitchBook data, Basta found that from 2014 to 2017, “The number of VC rounds in technology companies worldwide has nearly halved, from 19,000 to 10,000.”

What this means, Basta writes, is that in absolute numbers much less capital is available to early-stage companies today than a few years ago. “Inevitably there will be a continued drop in the number of new startups, which cannot now rely on getting the first round raised easily in the current environment,” he writes.

Whether this dichotomy is healthy or disastrous for the tech ecosystem remains to be seen, Basta concludes.

In the fourth quarter of 2017, venture firms invested $23.75 billion in 1,772 companies through 1,778 deals, PitchBook data released today shows. That was almost 12 percent more capital than the $21.24 billion that VCs invested in the prior quarter, according to revised PitchBook data. The deal count declined nearly 11 percent from 1,997 third-quarter deals.

From the fourth quarter of 2016, when PitchBook determined that VCs invested $14.3 billion in 1,891 deals, venture capital investments increased by two-thirds while the deal count declined by almost 6 percent.

(Updates with 2017 venture activity from MoneyTree Report) A separate MoneyTree survey released today by PricewaterhouseCoopers and CB Insights set total VC investments in U.S. companies at $71.9 billion, driven by 109 mega-round financings of $100 million or more. The MoneyTree report said that was invested in5,052 deals, down 4 percent from the 5,268 deals counted in 2016 and the lowest deal count since 2012.

Venture-backed exits also declined in 2017 to 769, according to the Venture Monitor report. That was down from 857 in 2016 and the lowest total since 2011. According to the statement from Venture Monitor, “The decline has been perpetuated by the notable trend of companies raising additional private funding rather than seeking an exit via an IPO or strategic acquirer. While exit counts have continued to decline, exit value has remained relatively flat thanks to the record number of unicorn exits in 2017.”

One trend worth noting is an uptick in private equity buyouts. Of the 769 exits in 2017, the Venture Monitor data showed that 146 (or 19 percent) were private equity buyouts.

Another noteworthy trend: Venture investments in the U.S. life sciences companies hit a total of $17.6 billion in 2017, the biggest in a decade, at least according to Venture Monitor data. That was invested in 1,093 deals nationwide.

Here are the top 10 venture deals in the fourth quarter, according to Venture Monitor:

| Lyft | $1.5 billion | Software | San Francisco |

| Grail Bio | $1.2 billion | Diagnostics | Menlo Park, CA |

| Faraday Future | $1 billion | Transportation | Los Angeles |

| Magic Leap | $502 million | Hardware | Plantation, FL |

| Compass | $500 million | Services | New York |

| SpaceX | $450 million | Aerospace | Hawthorne, CA |

| Essential Products | $300 million | Consumer | Palo Alto, CA |

| Ginkgo Bioworks | $275 million | Pharma | Boston |

| Harmony Biosciences | $270 million | Pharma | Philadelphia |

| Via | $250 million | Software | New York |

Find out more about DAI Magister