While venture investing outside the US has come a long way in recent years, our analysis shows it remains an entirely different industry than US VC. And when we say different, we mean TOTALLY different.

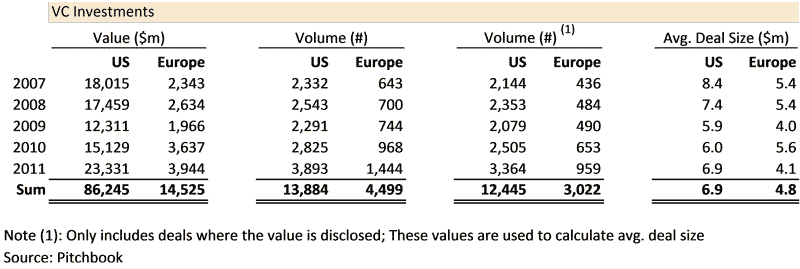

We looked at venture investment trends in 2007-2011 from PitchBook and compared them with VC exit results in 2012-16, to very roughly compare investment in one 5 year period with exit results in the ensuing next 5 years, roughly matching VC investment cycles.

Investment trends show ‘what you would expect’

Over 2007-11, European venture started to accelerate. Of course the industry remained a fraction of the US in size, but by 2011 there were 1400+ European investments made vs just under 4,000 in the US, a healthy jump in activity. And average round size was nearly $5m vs, $7m for the US. All indicative of a European VC industry developing rapidly from a much smaller base.

Exit trends point to entirely different industries

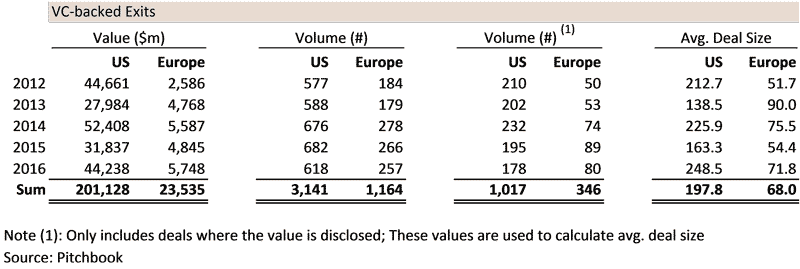

The subsequent 5 years, 2012-16, show entirely different exit profiles. Its encapsulated in a single number on the bottom right of the chart below:

The average US VC exit is nearly $200m, versus $70m for Europe. Of course this is not because the typical exit is exactly this, but because of the far greater number of $250m exits in the US vs Europe.

The number of $250m+ exits during this 5 year period? 22 across all of Europe, versus 166 in the US. That’s a huge, persistent disparity, especially given the evolution of European venture over the past decade.

Our view

- While European venture has come on leaps and bounds, it remains a ‘smaller round, smaller exit’ market

- It is extremely dangerous for European earlier stage VC’s to raise ever-larger funds, or early stage European companies to take very large A or B rounds. The European exit market is still far less developed, and putting more into companies can only damage returns

- The above has nothing to do with ambition, it simply reflects a current reality slowly changing; to make significant returns CEO’s and investors need to invest less into more capital efficient businesses that can return enough in a smaller, though successful exit

- A ‘good’ exit in Europe is $100m+, a ‘good’ exit in the US is $250m+

We believe it will take 20-30 years for European venture to have the same investment/exit dynamics as the US. We firmly believe it will get there, but meanwhile tempered enthusiasm is likely far more profitable than world domination strategies.