As the logistics industry faces unprecedented challenges, Artificial Intelligence (AI) has emerged as a game-changer. With a projected 46% CAGR from 2022 to 2030, the AI-powered logistics sector is expected to reach a $65 billion valuation…

Africa’s data centre market is growing at an unprecedented rate, driven by increasing internet penetration, rapid adoption of cloud computing, and soaring demand for digital services. As the continent embraces the digital revolution, the data centre market is projected to reach over $7 billion by 2028, an annual growth rate (CAGR 2024-2028) of 7%…

In 2023, the agri-tech landscape experienced a significant contraction, with investments plummeting to $7.1 billion—nearly 40% below the previous year’s $11.8 billion. This downturn, indicative of a broader decline in venture capital enthusiasm, was particularly pronounced in indoor farming, where investment fell sharply from over $2 billion in 2022 to less than $500 million, as reported by PitchBook…

Digital identity fraud is a growing threat, with the U.S. economy suffering over $52 billion in fraud-related losses in 2021 alone. Peer-to-Peer (P2P) payment fraud rose by over 100% year-over-year, with account takeovers and P2P payments fraud also recording double-digit growth. As online transactions and remote interactions become increasingly commonplace, the need for robust identity verification solutions has never been greater…

As the logistics industry faces unprecedented challenges, Artificial Intelligence (AI) has emerged as a game-changer. With a projected 46% CAGR from 2022 to 2030, the AI-powered logistics sector is expected to reach a $65 billion valuation…

Africa’s data centre market is growing at an unprecedented rate, driven by increasing internet penetration, rapid adoption of cloud computing, and soaring demand for digital services. As the continent embraces the digital revolution, the data centre market is projected to reach over $7 billion by 2028, an annual growth rate (CAGR 2024-2028) of 7%…

In 2023, the agri-tech landscape experienced a significant contraction, with investments plummeting to $7.1 billion—nearly 40% below the previous year’s $11.8 billion. This downturn, indicative of a broader decline in venture capital enthusiasm, was particularly pronounced in indoor farming, where investment fell sharply from over $2 billion in 2022 to less than $500 million, as reported by PitchBook…

Africa’s mid-market businesses, the backbone of the continent’s economic growth, face a massive $3 billion financing gap. With annual revenues over $10 million, these companies are too large for microfinance but too small or risky for traditional banks. This untapped opportunity…

As digital payments soar, so do sophisticated scams – UK fraud topped £1.2B in 2022. Regulators are mandating stricter security, driving the fraud prevention market to $67B by 2028…

Recent advances in large language models (LLMs) have ignited a revolution in journalism, pushing AI into the heart of the newsroom. No longer relegated to an experimental technology or passing fad, many news industry leaders now recognise AI as a powerful force capable of reshaping the competitive and fragmented news sector.

At the core of our economy and the preservation of life on Earth lies an often-underappreciated asset, natural capital. Natural capital consists of Earth’s renewable and non-renewable resources; trees, soil, air, water, and all living organisms that provide essential ecosystem services such as CO2 capture, protection against soil erosion and flood risk, wildlife habitats, and pollination.

Feeding millions of Africans with fish protein

Building a credit-led neobank for Africa

Streamlining Africa’s complex supply chains to boost trade

Investing in African technology companies

Surviving & thriving after the Lagos State ride hailing ban

Solving Africa’s broken retail supply chain

Investing in Africa’s female founders

Transforming pharmacies into the ‘care co-ordination infrastructure’ for Africa

Tackling Africa’s $300bn logistics supply chain

Dare Okoudjou talks about building a pan-African payments company

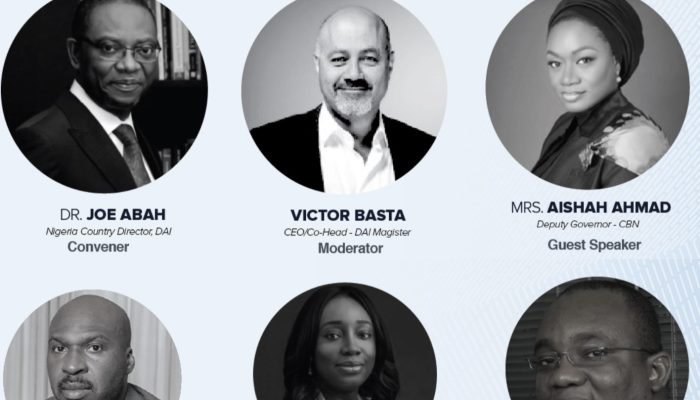

Last month, after a prolonged hiatus due to COVID-19, DAI Magister, in partnership with DAI Nigeria, held its first Development […]